Symantec 2006 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.model has been established. Our software has been available for general release concurrent with the

establishment of technological feasibility, and accordingly no software development costs have been capital-

ized in fiscal 2006, 2005, and 2004.

Acquired Product Rights

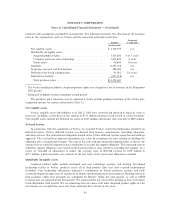

Acquired product rights are comprised of purchased product rights, technologies, databases and revenue-

related order backlog, and contracts from acquired companies. Acquired product rights are stated at cost less

accumulated amortization. Amortization of acquired product rights is provided on a straight-line basis over the

estimated useful lives of the respective assets, generally one to eight years, and is included in Cost of revenues

in the Consolidated Statements of Income.

Goodwill and Other Intangible Assets

We account for goodwill and other intangible assets in accordance with SFAS No. 142, Goodwill and

Other Intangible Assets. SFAS No. 142 requires that goodwill and identifiable intangible assets with indefinite

useful lives be tested for impairment at least annually, or more frequently if events and circumstances warrant.

We evaluate goodwill for impairment by comparing the fair value of each of our reporting units, which are the

same as our operating segments, to its carrying value, including the goodwill allocated to that reporting unit.

To determine the reporting units' fair values in the current year evaluation, we used the income approach

under which we calculate the fair value of each reporting unit based on the estimated discounted future cash

flows of that unit. Our cash flow assumptions are based on historical and forecasted revenue, operating costs,

and other relevant factors. SFAS No. 142 also requires that intangible assets with finite useful lives be

amortized over their respective estimated useful lives and reviewed for impairment in accordance with

SFAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets.

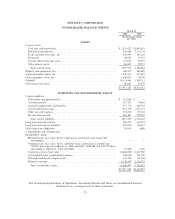

Long-Lived Assets

We account for long-lived assets in accordance with SFAS No. 144, which requires that long-lived and

intangible assets, including Property and equipment, net, Acquired product rights, net, and Other intangible

assets, net be evaluated for impairment whenever events or changes in circumstances indicate that the

carrying amount of an asset may not be recoverable. We would recognize an impairment loss when the sum of

the undiscounted future net cash flows expected to result from the use of the asset and its eventual disposition

is less than its carrying amount. Such impairment loss would be measured as the difference between the

carrying amount of the asset and its fair value. Assets to be disposed of would be separately presented in the

Consolidated balance sheets and reported at the lower of the carrying amount or fair value less costs to sell,

and no longer depreciated. The assets and liabilities of a disposal group classified as held for sale would be

presented separately in the appropriate asset and liability sections of the Consolidated Balance Sheets.

Income Taxes

We account for income taxes in accordance with SFAS No. 109, Accounting for Income Taxes. The

provision for income taxes is computed using the asset and liability method, under which deferred tax assets

and liabilities are recognized for the expected future tax consequences of temporary differences between the

financial reporting and tax bases of assets and liabilities, and for operating loss and tax credit carryforwards in

each jurisdiction in which we operate. Deferred tax assets and liabilities are measured using the currently

enacted tax rates that apply to taxable income in effect for the years in which those tax assets are expected to

be realized or settled. We record a valuation allowance to reduce deferred tax assets to the amount that is

believed more likely than not to be realized. We also account for any income tax contingencies in accordance

with SFAS No. 5, Accounting for Contingencies.

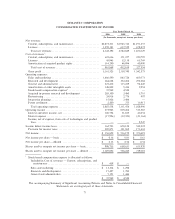

Net Income Per Share

Basic and diluted net income per share are presented in conformity with SFAS No. 128, Earnings per

Share, for all periods presented. Basic net income per share is computed using the weighted average number of

common shares outstanding during the periods. Diluted net income per share is computed using the weighted

average number of common shares outstanding and potentially dilutive common shares outstanding during the

periods. Potentially dilutive common shares include the assumed exercise of stock options using the treasury

78