Symantec 2006 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements Ì (Continued)

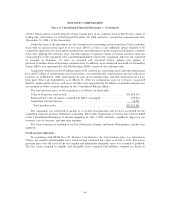

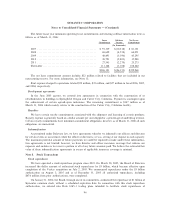

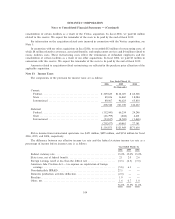

March 31, 2005

Amortized Unrealized Unrealized Estimated

Cost Gains Losses Fair Value

(In thousands)

Cash and cash equivalents:

CashÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 243,305 $Ì $ Ì $ 243,305

Money market funds ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 337,056 Ì Ì 337,056

Commercial paper ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 319,094 Ì Ì 319,094

Bank debt securities and depositsÏÏÏÏÏÏÏÏÏ 31,186 Ì Ì 31,186

Government and government-sponsored

debt securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 160,792 Ì Ì 160,792

Total cash and cash equivalents ÏÏÏÏÏÏÏÏ $1,091,433 $Ì $ Ì $1,091,433

Short-term investments:

Corporate debt securitiesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1,517,688 $88 $(1,563) $1,516,213

Government and government-sponsored

debt securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 592,112 Ì (634) 591,478

Other investments ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 7,463 Ì Ì 7,463

Total short-term investments ÏÏÏÏÏÏÏÏÏÏ $2,117,263 $88 $(2,197) $2,115,154

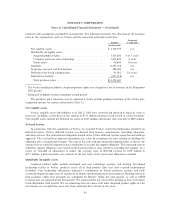

As of March 31, 2006, the unrealized losses in the above table relate to short-term investment securities

for which the fair value is less than the cost basis. In all cases, this condition has existed for less than one year.

We expect to receive the full principal and interest on these securities. When evaluating our investments for

possible impairment, we review factors such as the length of time and extent to which fair value has been

below cost basis, the financial condition of the investee, and our ability and intent to hold the investment for a

period of time which may be sufficient for anticipated recovery in market value. The changes in the values in

the above securities are considered to be temporary in nature and, accordingly, we do not believe that the

values of these securities are impaired as of March 31, 2006. Unrealized gains and losses on available-for-sale

securities are reported as a component of Stockholders' equity in the Consolidated Balance Sheets.

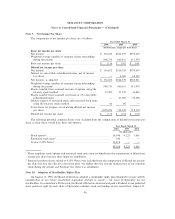

The estimated fair value of cash equivalents and short-term investments by contractual maturity as of

March 31, 2006 is as follows:

(In thousands)

Due in one year or lessÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $2,068,891

Due after one year and through 5 years ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 238,550

$2,307,441

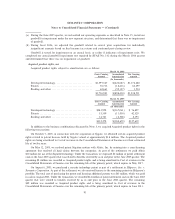

Equity investments in privately held companies

As of March 31, 2006 and 2005, we held equity investments with a carrying value of $11 million, in

several privately-held companies. These investments are recorded at cost as we do not have significant

influence over the investees and are included in Other long-term assets in the Consolidated Balance Sheets. In

fiscal 2006, 2005 and 2004, we recognized declines in value of these investments that were determined to be

other-than-temporary of $4 million, $1 million, and $3 million, respectively. The other-than-temporary

declines in fair value were recorded as Interest and other income, net in the Consolidated Statements of

Income.

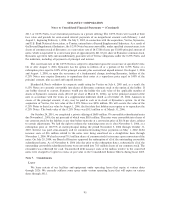

Note 6. Convertible Subordinated Notes

In connection with the acquisition of Veritas, we assumed the Veritas 0.25% convertible subordinated

notes. In August 2003, Veritas issued $520 million of 0.25% convertible subordinated notes due August 1,

94