Symantec 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

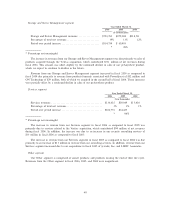

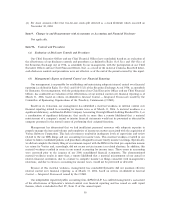

Provision for Income Taxes

Year Ended March 31,

2006 2005 2004

($ in thousands)

Tax provision on earningsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $227,068 $267,720 $171,603

Effective tax rate on earnings ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 63% 31% 32%

Tax provision on repatriation ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $(21,197) $ 54,249 $ Ì

Total tax provision ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $205,871 $321,969 $171,603

Total effective tax rate ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 57% 38% 32%

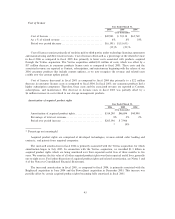

Our effective tax rate on income before taxes was approximately 57%, 38%, and 32% in fiscal 2006, 2005,

and 2004, respectively. The effective tax rate for fiscal 2006 reflects the impact of the IPR&D charges and

other acquisition-related charges that are nondeductible for tax reporting purposes, partially offset by foreign

earnings taxed at a lower rate than the U.S. tax rate, and the effect of the true-up of taxes on repatriated

earnings. The effective tax rate in fiscal 2005 reflects the additional tax expense attributable to the

$500 million of foreign earnings that we repatriated under the American Jobs Creation Act.

We believe realization of substantially all of our deferred tax assets as of March 31, 2006 of $467 million,

after application of the valuation allowance, is more likely than not based on the future reversal of temporary

tax differences. Realization of approximately $27 million of our deferred tax assets as of March 31, 2006 is

dependent upon future taxable earnings exclusive of reversing temporary differences in certain foreign

jurisdictions. Levels of future taxable income are subject to the various risks and uncertainties discussed in

Item 1A, Risk Factors, set forth in this annual report. An additional valuation allowance against net deferred

tax assets may be necessary if it is more likely than not that all or a portion of the net deferred tax assets will

not be realized. We will assess the need for an additional valuation allowance on a quarterly basis. The

valuation allowance on our deferred tax assets increased by $59 million in fiscal 2006, of which approximately

$58 million is attributable to acquisition-related assets, the benefit of which will reduce goodwill when and if

realized. The valuation allowance on our deferred tax assets increased by an immaterial amount in fiscal 2005.

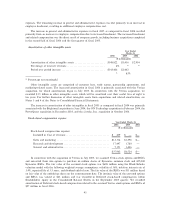

American Jobs Creation Act of 2004 Ì Repatriation of foreign earnings

In the March 2005 quarter, we repatriated $500 million from certain of our foreign subsidiaries that

qualified for the 85% dividends received deduction under the provisions of the American Jobs Creation Act of

2004, or the Jobs Act, enacted in October 2004. We recorded a tax charge for this repatriation of $54 million

in the March 2005 quarter.

In May 2005, clarifying language was issued by the U.S. Department of Treasury and the IRS with

respect to the treatment of foreign taxes paid on the earnings repatriated under the Jobs Act and in September

2005, additional clarifying language was issued regarding the treatment of certain deductions attributable to

the earnings repatriation. As a result of this clarifying language, we reduced the tax expense attributable to the

repatriation by approximately $21 million in fiscal 2006, which reduced the cumulative tax charge on the

repatriation to $33 million.

The $500 million repatriation under the Jobs Act was deemed to be distributed entirely from foreign

earnings that had been previously treated as indefinitely reinvested. However, this distribution from previously

indefinitely reinvested earnings does not change our position going forward that future earnings of certain of

our foreign subsidiaries will be indefinitely reinvested.

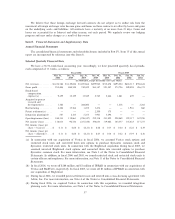

Other tax matters

On March 29, 2006, we received a Notice of Deficiency from the IRS claiming that we owe additional

taxes, plus interest and penalties, for the 2000 and 2001 tax years based on an audit of Veritas, which we

acquired in July 2005. The incremental tax liability asserted by the IRS with regard to the Veritas claim is

$867 million, excluding penalties and interest. The Notice of Deficiency primarily relates to transfer pricing in

connection with a technology license agreement between Veritas and a foreign subsidiary. We do not agree

50