Symantec 2006 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

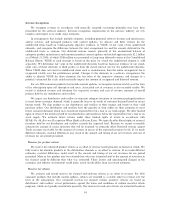

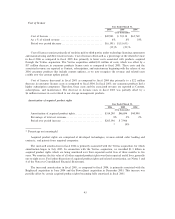

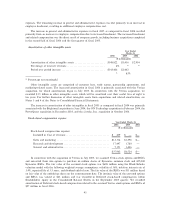

Cost of licenses

Year Ended March 31,

2006 2005 2004

($ in thousands)

Cost of licenses ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $45,943 $ 52,138 $65,769

As a % of related revenue ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 4% 8% 10%

Period over period decrease ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $(6,195) $(13,631)

(12)% (21)%

Cost of licenses consists primarily of royalties paid to third parties under technology licensing agreements

and manufacturing and direct material costs. Cost of licenses decreased as a percentage of the related revenue

in fiscal 2006 as compared to fiscal 2005 due primarily to lower costs associated with products acquired

through the Veritas acquisition. The Veritas acquisition added $13 million of costs, which was offset by a

$17 million decrease in consumer products license costs as compared to fiscal 2005. These costs and the

associated revenue are reported as Content, subscriptions, and maintenance beginning with the release of our

2006 consumer products that include content updates, as we now recognize the revenue and related costs

ratably over the content update period.

Cost of licenses decreased in fiscal 2005 as compared to fiscal 2004 due primarily to a $22 million

decrease in consumer licenses costs as compared to fiscal 2004. In fiscal 2005, our consumer products had a

higher subscription component. Therefore, these costs and the associated revenue are reported as Content,

subscriptions, and maintenance. The decrease in licenses costs in fiscal 2005 was partially offset by a

$6 million increase in cost related to our storage management products.

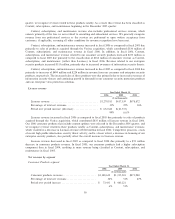

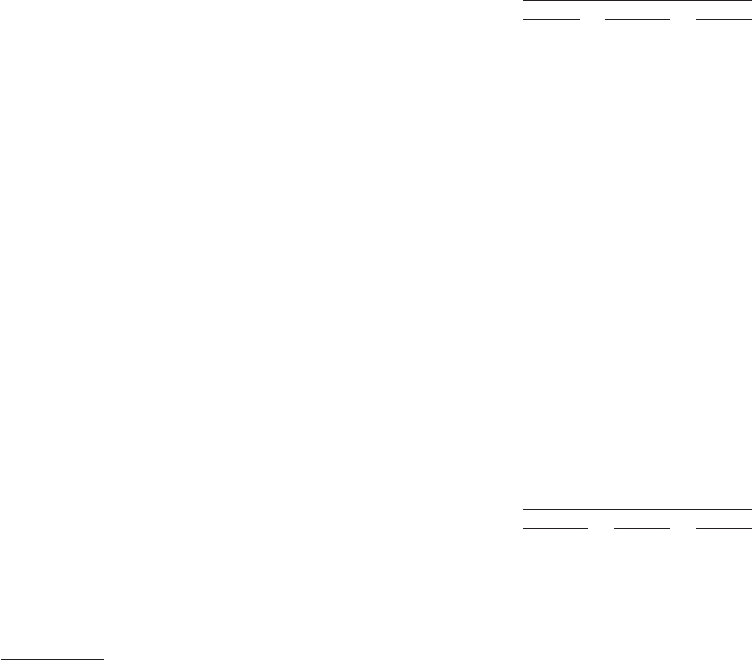

Amortization of acquired product rights

Year Ended March 31,

2006 2005 2004

($ in thousands)

Amortization of acquired product rightsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $314,290 $48,894 $40,990

Percentage of total net revenues ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 8% 2% 2%

Period over period increase ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $265,396 $ 7,904

* 19%

* Percentage not meaningful

Acquired product rights are comprised of developed technologies, revenue-related order backlog and

contracts, and patents from acquired companies.

The increased amortization in fiscal 2006 is primarily associated with the Veritas acquisition, for which

amortization began in July 2005. In connection with the Veritas acquisition, we recorded $1.3 billion in

acquired product rights which are being amortized over their expected useful lives of three months to five

years. We amortize the fair value of all other acquired product rights over their expected useful lives, generally

one to eight years. For further discussion of acquired product rights and related amortization, see Notes 3 and

4 of the Notes to Consolidated Financial Statements.

The increased amortization in fiscal 2005, as compared to fiscal 2004, is primarily associated with the

Brightmail acquisition in June 2004 and the PowerQuest acquisition in December 2003. This increase was

partially offset by certain acquired product rights becoming fully amortized in fiscal 2005.

43