Symantec 2006 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SYMANTEC CORPORATION

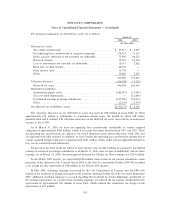

Notes to Consolidated Financial Statements Ì (Continued)

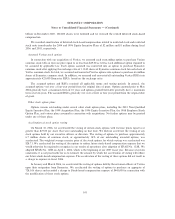

services from AOL at a stated value of $20 million. In March 2003, Veritas restated its financial statements

for 2001 and 2000 to reflect a reduction in revenues and expenses of $20 million, as well as an additional

reduction in revenues and expenses of $1 million related to two other contemporaneous transactions with other

parties in 2000 that involved software licenses and the purchase of online advertising services. In March 2005,

the SEC charged AOL with securities fraud pursuant to a complaint entitled Securities and Exchange

Commission v. Time Warner, Inc. In its complaint, the SEC described certain transactions between AOL and

a ""California-based software company that creates and licenses data storage software'' that appear to reference

Veritas' transactions with AOL as described above, and alleged that AOL aided and abetted that California-

based software company in violating Section 10(b) of the Securities Exchange Act of 1934 and Exchange Act

Rule 10b-5.

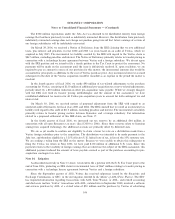

In March 2004, Veritas announced its intention to restate its financial statements for 2002 and 2001 and

to revise previously announced financial results for 2003. The decision resulted from the findings of an

investigation into past accounting practices that concluded on March 12, 2004. In the first quarter of 2004,

Veritas voluntarily disclosed to the staff of the SEC past accounting practices applicable to its 2002 and 2001

financial statements that were not in compliance with GAAP. In June 2004, Veritas restated its financial

statements for 2002 and 2001 and reported revised financial results for 2003.

Prior to our acquisition of Veritas, Veritas had been in discussions with the staff of the SEC regarding the

SEC's review of these matters and, based on communications with the staff, Veritas expected these

discussions to result in a settlement with the SEC in which we would be required to pay a $30 million penalty.

We would be unable to deduct the $30 million penalty for income tax purposes, be reimbursed or indemnified

for such payment through insurance or any other source, or use the payment to setoff or reduce any award of

compensatory damages to plaintiffs in related securities litigation. Final settlement with the SEC is subject to

agreement on final terms and documentation, approval by Symantec's board of directors, and approval by the

SEC Commissioners. In the March quarter of 2005, Veritas recorded a charge of $30 million in its

consolidated statement of operations, and a corresponding accrual in its balance sheet. As of the filing of this

annual report, the terms of the final settlement are still under consideration by the SEC Commissioners, and

have not been approved. As part of our accounting for the acquisition of Veritas, we recorded the accrual of

$30 million in Other accrued expenses in the Consolidated Balance Sheets. We intend to cooperate with the

SEC in its investigation and review of the foregoing matters.

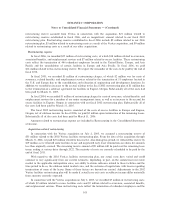

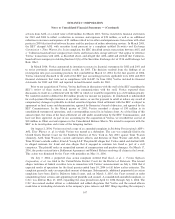

On August 2, 2004, Veritas received a copy of an amended complaint in Stichting Pensioenfonds ABP v.

AOL Time Warner, et. al. in which Veritas was named as a defendant. The case was originally filed in the

United States District Court for the Southern District of New York in July 2003 against Time Warner

(formerly, AOL Time Warner), current and former officers and directors of Time Warner and AOL, and

Time Warner's outside auditor, Ernst & Young LLP. The plaintiff alleges that Veritas aided and abetted AOL

in alleged common law fraud and also alleges that it engaged in common law fraud as part of a civil

conspiracy. The plaintiff seeks an unspecified amount of compensatory and punitive damages. On March 17,

2006, the parties entered into a Settlement Agreement and Mutual Release resolving all claims in the lawsuit.

This action was dismissed by the Court with prejudice on May 31, 2006.

On July 7, 2004, a purported class action complaint entitled Paul Kuck, et al. v. Veritas Software

Corporation, et al. was filed in the United States District Court for the District of Delaware. The lawsuit

alleges violations of federal securities laws in connection with Veritas' announcement on July 6, 2004 that it

expected results of operations for the fiscal quarter ended June 30, 2004 to fall below earlier estimates. The

complaint generally seeks an unspecified amount of damages. Subsequently, additional purported class action

complaints have been filed in Delaware federal court, and, on March 3, 2005, the Court entered an order

consolidating these actions and appointing lead plaintiffs and counsel. A consolidated amended complaint, or

CAC, was filed on May 27, 2005, expanding the class period from April 23, 2004 through July 6, 2004. The

CAC also named another officer as a defendant and added allegations that Veritas and the named officers

made false or misleading statements in the company's press releases and SEC filings regarding the company's

107