Symantec 2006 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

stock method, the dilutive impact of restricted stock and restricted stock units using the treasury stock

method, and conversion of debt, if dilutive in the period. Potentially dilutive common shares are excluded in

net loss periods, as their effect would be antidilutive.

Stock-Based Compensation

We account for stock-based compensation awards to employees using the intrinsic value method in

accordance with Accounting Principles Board Opinion, or APB, No. 25, Accounting for Stock Issued to

Employees, and to non-employees using the fair value method in accordance with SFAS No. 123, Accounting

for Stock-Based Compensation. In addition, we apply applicable provisions of FIN 44, Accounting for Certain

Transactions Involving Stock Compensation, an Interpretation of APB No. 25. As discussed in Note 3, in

connection with the acquisition of Veritas, we assumed outstanding options to purchase shares of Veritas

common stock and converted them into options to purchase 66 million shares of Symantec common stock.

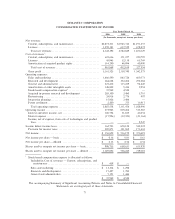

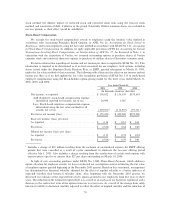

Pro forma information regarding net income and net income per share is required by SFAS No. 123. This

information is required to be determined as if we had accounted for our employee stock options, including

shares issued under the Employee Stock Purchase Plan, or ESPP, granted subsequent to March 31, 1995,

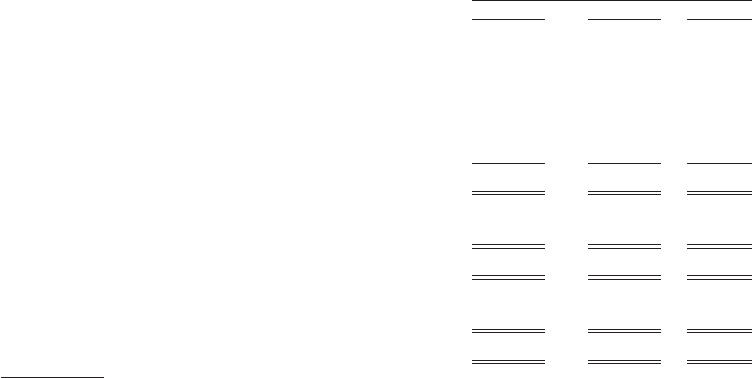

under the fair value method of that statement. The following table illustrates the effect on net income and net

income per share as if we had applied the fair value recognition provisions of SFAS No. 123 to stock-based

employee compensation using the Black-Scholes option-pricing model for the three years ended March 31,

2006, 2005, and 2004:

Year Ended March 31,

2006 2005 2004

(In thousands, except per share data)

Net income, as reportedÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 156,852 $ 536,159 $370,619

Add: Employee stock-based compensation expense

included in reported net income, net of tax ÏÏÏÏÏÏÏÏ 26,996 3,087 Ì

Less: Stock-based employee compensation expense

determined using the fair value method for all

awards, net of tax ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (239,071)1(116,957) (97,711)

Pro forma net income (loss) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ (55,223) $ 422,289 $272,908

Basic net income (loss) per share:

As reported ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 0.16 $ 0.81 $ 0.61

Pro formaÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ (0.06) $ 0.64 $ 0.45

Diluted net income (loss) per share:

As reported ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 0.15 $ 0.74 $ 0.54

Pro formaÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ (0.06) $ 0.59 $ 0.41

1Includes a charge of $18 million resulting from the inclusion of unamortized expense for ESPP offering

periods that were cancelled as a result of a plan amendment to eliminate the two-year offering period

effective July 1, 2005. Also includes a charge resulting from the acceleration of certain stock options with

exercise prices equal to or greater than $27 per share outstanding on March 30, 2006.

In light of new accounting guidance under SFAS No. 123R, Share-Based Payment, which addresses

option valuation for employee awards, we have reevaluated our assumptions used in estimating the fair value

of employee options granted beginning in the December 2005 quarter. Based on this assessment, management

has determined that historical volatility adjusted for the effect of implied volatility is a better indicator of

expected volatility than historical volatility alone. Also, beginning with the December 2005 quarter, we

decreased our estimate of the expected life of new options granted to our employees from five years to three

years. The reduction in the estimated expected life was a result of an analysis of our historical experience and a

decrease in the contractual term of the options from ten to seven years. As a result of the change from solely

historical volatility to historical volatility adjusted to reflect the effect of implied volatility and the reduction of

79