Symantec 2006 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Veritas Acquisition

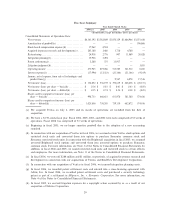

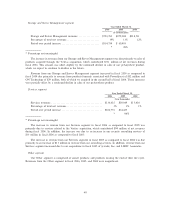

On July 2, 2005, we completed the acquisition of Veritas Software Corporation, or Veritas, a leading

provider of software and services to enable storage and backup, whereby Veritas became a wholly owned

subsidiary of Symantec in a transaction accounted for using the purchase method. The total purchase price of

$13.2 billion includes Symantec common stock valued at $12.5 billion, assumed stock options and restricted

stock units, or RSUs, with a fair value of $699 million, and acquisition-related expenses of $39 million. The

acquisition of Veritas will enable us to provide enterprise customers with a more effective way to secure and

manage their most valuable asset, their information. The combined company offers customers a broad

portfolio of leading software and solutions across all tiers of the infrastructure. We believe that this acquisition

better positions us to help enable our customers to build a resilient IT infrastructure, manage a complex

heterogeneous IT environment, and reduce overall IT risk. In addition, we believe that bringing together the

market leading capabilities of Symantec and Veritas improves our ability to continuously optimize perform-

ance and help companies recover from disruptions when they occur.

As a result of the acquisition, we issued approximately 483 million shares of Symantec common stock,

net of treasury stock retained, options to purchase 66 million shares of Symantec common stock, and 425,000

RSUs, based on an exchange ratio of 1.1242 shares of Symantec common stock for each outstanding share of

Veritas common stock as of July 2, 2005. The common stock issued had a fair value of $12.5 billion and was

valued using the average closing price of our common stock of $25.87 over a range of trading days

(December 14, 2004 through December 20, 2004, inclusive) around the announcement date (December 16,

2004) of the transaction. Under the terms of the agreement, we assumed each outstanding option to purchase

Veritas common stock with an exercise price equal to or less than $49.00, as well as each additional option

required to be assumed by applicable law. Each option assumed was converted into an option to purchase

Symantec common stock based upon the exchange ratio. All other options to purchase shares of Veritas

common stock not exercised prior to the acquisition were cancelled immediately prior to the acquisition and

were not converted or assumed by Symantec. In addition, we assumed all of the Veritas outstanding RSUs and

converted them into 425,000 Symantec RSUs, after applying the exchange ratio. The assumed options and

RSUs had a fair value of $699 million.

In connection with the acquisition, we have recorded $8.6 billion of goodwill, $1.3 billion of acquired

product rights, $1.5 billion of other intangible assets, $63 million of deferred stock-based compensation, and

$2.3 billion of net tangible assets. In addition, we wrote off acquired in-process research and development, or

IPR&D, of $284 million because the acquired technologies had not reached technological feasibility and had

no alternative uses. We also incurred acquisition related expenses of $39 million, which consisted of

$32 million for legal and other professional fees and $7 million of restructuring costs for severance, associated

benefits, outplacement services, and excess facilities. The acquisition was structured to qualify as a tax-free

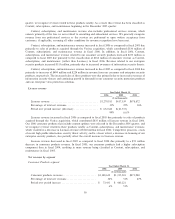

reorganization and we have accounted for it using the purchase method of accounting. The results of Veritas'

operations have been included in our results of operations beginning on July 2, 2005, and had a significant

impact on our revenues, cost of revenues, and operating expenses during fiscal 2006.

In connection with the acquisition of Veritas, we assumed Veritas' contractual obligations related to its

deferred revenue. Veritas' deferred revenue was derived from maintenance, consulting, education, and other

services. We estimated our obligation related to Veritas' deferred revenue using the cost build-up approach.

The cost build-up approach determines fair value by estimating the costs relating to fulfilling the obligation

plus a normal profit margin. The sum of the costs and operating profit approximates, in theory, the amount

that we would be required to pay a third party to assume the support obligation. The estimated costs to fulfill

the support obligation were based on the historical direct costs related to providing the support. As a result, we

recorded an adjustment to reduce the carrying value of deferred revenue by $359 million to $173 million,

which represents our estimate of the fair value of the contractual obligations assumed.

The Veritas business is included in our Data Protection, Storage and Server Management, and Services

segments.

31