Symantec 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

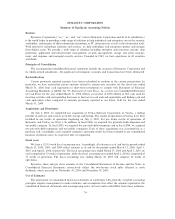

the expected life, the pro forma expense will be reduced by an aggregate of approximately $32 million over the

four-year average vesting period beginning with options granted in the quarter ended December 31, 2005.

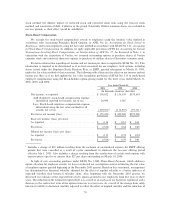

For the pro forma amounts determined under SFAS No. 123, as set forth above, the fair value of each

stock option granted under the stock option plans or assumed in a business combination is estimated on the

date of grant or assumption using the Black-Scholes option-pricing model with the following weighted-average

assumptions:

Employee Employee Stock

Stock Options Purchase Plans

2006 2005 2004 2006 2005 2004

Expected life (years)ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 3 5 5 0.5 1.25 1.25

Expected volatility ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 0.45 0.64 0.69 0.33 0.36 0.46

Risk free interest rate ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 3.55% 3.71% 3.00% 4.26% 2.33% 1.00%

The weighted average estimated fair value of employee stock options granted in fiscal 2006, 2005, and

2004 was $7.81, $15.46, and $8.73 per share, respectively. The weighted average estimated fair value of

employee stock purchase rights granted under the ESPP in fiscal 2006, 2005, and 2004 was $3.16, $8.19, and

$4.36, respectively.

For purposes of pro forma disclosure, the estimated fair value of the options is amortized to expense using

the straight-line method over the options' vesting period for employee stock options and over the six-month

purchase period for stock purchases under the ESPP.

On March 30, 2006, we accelerated the vesting of certain stock options with exercise prices equal to or

greater than $27.00 per share that were outstanding on that date. We did not accelerate the vesting of any

stock options held by our executive officers or directors. The vesting of options to purchase approximately

6.7 million shares of common stock, or approximately 14% of our outstanding unvested options, was

accelerated. The weighted average exercise price of the stock options for which vesting was accelerated was

$28.73. We accelerated the vesting of the options to reduce future stock-based compensation expense that we

would otherwise be required to recognize in our results of operations after adoption of SFAS No. 123R. We

adopted SFAS No. 123R on April 1, 2006, which is the beginning of our 2007 fiscal year. Because of system

constraints, it is not practicable for us to estimate the amount by which the acceleration of vesting will reduce

our future stock-based compensation expense. The acceleration of the vesting of these options did not result in

a charge to expense in fiscal 2006.

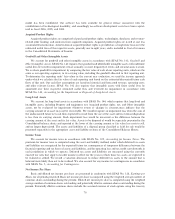

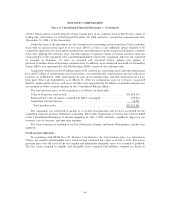

Concentrations of Credit Risk

A significant portion of our revenues and net income is derived from international sales and independent

agents and distributors. Fluctuations of the U.S. dollar against foreign currencies, changes in local regulatory

or economic conditions, piracy, or nonperformance by independent agents or distributors could adversely

affect operating results.

Financial instruments that potentially subject us to concentrations of credit risk consist principally of cash

and cash equivalents, short-term investments, trade accounts receivable, and forward foreign exchange

contracts. Our investment portfolio is diversified and consists of investment grade securities. Our investment

policy limits the amount of credit risk exposure to any one issuer and in any one country. We are exposed to

credit risks in the event of default by the issuers to the extent of the amount recorded in the Consolidated

Balance Sheets. The credit risk in our trade accounts receivable is substantially mitigated by our credit

evaluation process, reasonably short collection terms, and the geographical dispersion of sales transactions. We

maintain reserves for potential credit losses and such losses have been within management's expectations.

Legal Expenses

We accrue estimated legal expenses when the likelihood of the incurrence of the related costs is probable

and management has the ability to estimate such costs. If both of these conditions are not met, management

80