Symantec 2006 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Financial Results

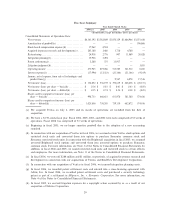

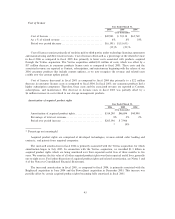

Our net income was $157 million, $536 million, and $371 million for fiscal 2006, 2005, and 2004,

respectively, representing diluted net income per share of $0.15, $0.74, and $0.54, respectively. The decreased

profitability in fiscal 2006 is primarily due to the write-off of acquired IPR&D and increased amortization of

acquired product rights and other intangible assets as a result of the Veritas acquisition, as well as non-merger

related restructuring charges. In addition, we experienced an increase in operating expenses primarily

attributable to the Veritas acquisition, and specifically an increase in employee headcount and related

compensation. As of March 31, 2006, employee headcount increased by approximately 148% from March 31,

2005. Approximately 71% of the increase was due to the Veritas acquisition.

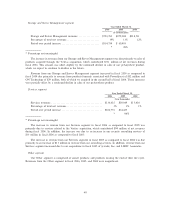

Fiscal 2006 delivered global revenue growth across all of our geographic regions as compared to fiscal

2005 and 2004. The overall growth is due primarily to the Veritas acquisition and is also partly attributable to

increased awareness of Internet related threats around the world. Weakness in most major foreign currencies

negatively impacted our international revenue growth by $48 million in fiscal 2006 compared to fiscal 2005.

We are unable to predict the extent to which revenues in future periods will be impacted by changes in foreign

currency exchange rates. If international sales become a greater portion of our total sales in the future,

changes in foreign exchange rates may have a potentially greater impact on our revenues and operating results.

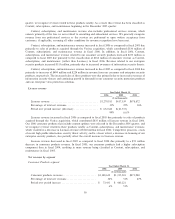

In the December 2005 quarter, we released our 2006 consumer products and increased subscription

pricing for those 2006 consumer products that include content updates. As a result, revenue for the 2006

consumer products that include content updates is recognized on a ratable basis over the term of the license.

In addition, beginning in the December 2005 quarter, this revenue is now classified as Content, subscriptions,

and maintenance revenue.

Cash flows were strong in fiscal 2006 as we delivered over $1.5 billion in operating cash flow. We ended

fiscal 2006 with $2.9 billion in cash, cash equivalents, and short-term investments.

On April 1, 2006, we adopted Statement of Financial Accounting Standards, or SFAS, No. 123R, Share-

Based Payment. We expect the adoption of SFAS No. 123R to have a material impact on our consolidated

financial position and results of operations.

CRITICAL ACCOUNTING ESTIMATES

The preparation of our consolidated financial statements and related notes in accordance with generally

accepted accounting principles requires us to make estimates, which include judgments and assumptions, that

affect the reported amounts of assets, liabilities, revenue, and expenses, and related disclosure of contingent

assets and liabilities. We have based our estimates on historical experience and on various assumptions that we

believe to be reasonable under the circumstances. We evaluate our estimates on a regular basis and make

changes accordingly. Historically, our critical accounting estimates have not differed materially from actual

results; however, actual results may differ from these estimates under different conditions. If actual results

differ from these estimates and other considerations used in estimating amounts reflected in our consolidated

financial statements, the resulting changes could have a material adverse effect on our Consolidated

Statements of Income, and in certain situations, could have a material adverse effect on liquidity and our

financial condition.

A critical accounting estimate is based on judgments and assumptions about matters that are uncertain at

the time the estimate is made. Different estimates that reasonably could have been used or changes in

accounting estimates could materially impact the financial statements. We believe that the estimates

described below represent our critical accounting estimates, as they have the greatest potential impact on our

consolidated financial statements. We also refer you to our Summary of Significant Accounting Policies

beginning on page 74 of this annual report.

33