Symantec 2006 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SYMANTEC CORPORATION

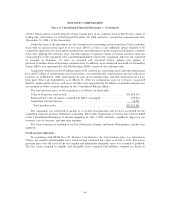

Notes to Consolidated Financial Statements Ì (Continued)

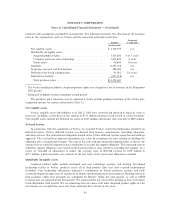

Deferred stock-based compensation

We assumed Veritas' stock options and RSUs, and converted them into stock options to

purchase 66 million shares of Symantec common stock and 425,000 Symantec RSUs. The fair value of the

assumed stock options was $688 million using the Black-Scholes valuation model with the following weighted

average assumptions: volatility of 36%, risk-free interest rate of 3.4%, expected life of 3.5 years, and dividend

yield of zero. The fair value of the RSUs was $11 million based on the fair value of the underlying shares on

the announcement date. The intrinsic value of the unvested options and RSUs was valued at $63 million and

was recorded in Deferred stock-based compensation within Stockholders' equity in the Consolidated Balance

Sheets in the September 2005 quarter. The difference between the fair value and the intrinsic value of the

unvested portion of the options and RSUs was $636 million and was included in the purchase price

consideration.

The deferred stock-based compensation is being amortized to operating expense over the remaining

vesting periods of the underlying options or RSUs on a straight-line basis. During the period from the

acquisition date through March 31, 2006, certain unvested options and RSUs were cancelled as a result of

employee terminations, and deferred stock-based compensation was reduced by $6 million. We recorded

amortization of deferred stock-based compensation from the Veritas transaction of $27 million in fiscal 2006.

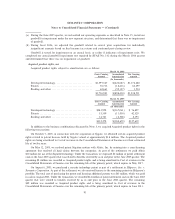

Deferred tax liability

We have recognized deferred tax assets and liabilities for the tax effects of differences between assigned

values in the purchase price and the tax bases of assets acquired and liabilities assumed. A significant portion

of the net deferred tax liability in the purchase price allocation is attributable to the tax effect of the difference

between the assigned value of identified intangible assets and their tax bases. In determining the tax effect of

these basis differences, we have taken into account the allocation of these identified intangibles among

different taxing jurisdictions, including those with nominal or zero percent tax rates.

Short-term loan

In connection with the acquisition of Veritas, we assumed a short-term loan with a principal amount of

EURO 411 million. We paid the entire balance of the short-term loan on July 7, 2005.

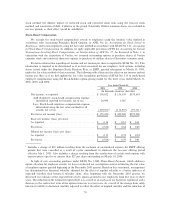

Pro forma results

The following table presents pro forma results of operations of Symantec and Veritas, as though the

companies had been combined as of the beginning of the earliest period presented. The unaudited pro forma

results of operations are not necessarily indicative of results that would have occurred had the acquisition

taken place on April 1, 2004 or of results that may occur in the future. Pro forma net income includes

amortization of intangible assets related to the acquisition of $119 million per quarter and amortization of

deferred stock-based compensation of $6 million per quarter. Pro forma net income also includes amortization

of backlog of $46 million for fiscal 2005. We excluded the effect of the purchase accounting adjustment to

87