Symantec 2006 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements Ì (Continued)

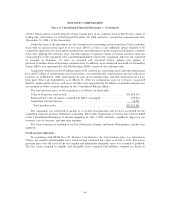

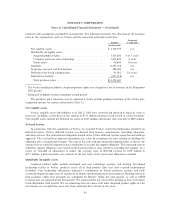

estimates and assumptions provided by management. The following represents the allocation of the purchase

price to the acquired net assets of Veritas and the associated estimated useful lives:

Estimated

Amount Useful Life

(In thousands)

Net tangible assets ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 2,300,199 n/a

Identifiable intangible assets:

Acquired product rights ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,301,600 4 to 5 years1

Customer contracts and relationships ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,419,400 8 years

Trade name ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 96,800 10 years

GoodwillÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 8,597,768 n/a

In-process research and development ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 284,000 n/a

Deferred stock-based compensation ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 63,092 2.8 years2

Deferred tax liabilityÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (827,218) n/a

Total purchase price ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $13,235,641

1The Veritas backlog included in Acquired product rights was charged to Cost of revenues in the September

2005 quarter.

2Estimated weighted-average remaining vesting period.

The purchase price allocation may be adjusted in future periods pending resolution of the Veritas pre-

acquisition income tax matters discussed in Note 13.

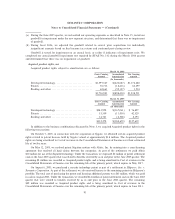

Net tangible assets

Veritas' tangible assets and liabilities as of July 2, 2005 were reviewed and adjusted to their fair value as

necessary, including a write down in the amount of $113 million relating to land owned in various locations.

Net tangible assets include net deferred tax assets of $223 million and income taxes payable of $269 million.

Deferred revenue

In connection with the acquisition of Veritas, we assumed Veritas' contractual obligations related to its

deferred revenue. Veritas' deferred revenue was derived from licenses, maintenance, consulting, education,

and other services. We estimated our obligation related to the Veritas deferred revenue using the cost build-up

approach. The cost build-up approach determines fair value by estimating the costs relating to fulfilling the

obligation plus a normal profit margin. The sum of the costs and operating profit approximates, in theory, the

amount that we would be required to pay a third party to assume the support obligation. The estimated costs to

fulfill the support obligation were based on the historical direct costs related to providing the support. As a

result, we recorded an adjustment to reduce the carrying value of deferred revenue by $359 million to

$173 million, which represents our estimate of the fair value of the contractual obligations assumed.

Identifiable intangible assets

Acquired product rights include developed and core technology, patents, and backlog. Developed

technology relates to Veritas' products across all of their product lines that have reached technological

feasibility. Core technology and patents represent a combination of Veritas processes, patents, and trade

secrets developed through years of experience in design and development of their products. Backlog relates to

firm customer orders that generally are scheduled for delivery within the next quarter, as well as OEM

revenues that are reported in the next quarter. We amortized the fair value of the backlog to Cost of revenues

in the September 2005 quarter. We are amortizing the fair values of all other Acquired product rights to Cost

of revenues on a straight-line basis over their estimated lives of four to five years.

85