Symantec 2006 Annual Report Download - page 41

Download and view the complete annual report

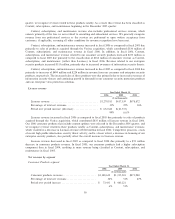

Please find page 41 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the terms and conditions of the promotional programs, actual sales during the promotion, amount of actual

redemptions received, historical redemption trends by product and by type of promotional program, and the

value of the rebate. We also consider current market conditions and economic trends when estimating our

reserves for rebates. If we made different estimates, material differences may result in the amount and timing

of our net revenues for any period presented.

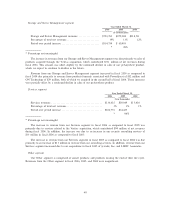

Business Combinations

When we acquire businesses, we allocate the purchase price to tangible assets and liabilities and

identifiable intangible assets acquired. Any residual purchase price is recorded as goodwill. The allocation of

the purchase price requires management to make significant estimates in determining the fair values of assets

acquired and liabilities assumed, especially with respect to intangible assets. These estimates are based on

historical experience and information obtained from the management of the acquired companies. These

estimates can include, but are not limited to, the cash flows that an asset is expected to generate in the future,

the appropriate weighted average cost of capital, and the cost savings expected to be derived from acquiring an

asset. These estimates are inherently uncertain and unpredictable. In addition, unanticipated events and

circumstances may occur which may affect the accuracy or validity of such estimates.

At March 31, 2006, goodwill was $10.3 billion, other intangible assets, net were $1.4 billion, and acquired

product rights, net were $1.2 billion. We assess the impairment of goodwill within our reporting units annually,

or more often if events or changes in circumstances indicate that the carrying value may not be recoverable.

We evaluate goodwill for impairment by comparing the fair value of each of our reporting units, which are the

same as our operating segments, to its carrying value, including the goodwill allocated to that reporting unit.

To determine the reporting units' fair values in the current year evaluation, we used the income approach

under which we calculate the fair value of each reporting unit based on the estimated discounted future cash

flows of that unit. Our cash flow assumptions are based on historical and forecasted revenue, operating costs,

and other relevant factors. If management's estimates of future operating results change, or if there are

changes to other assumptions, the estimate of the fair value of our goodwill could change significantly. Such

change could result in goodwill impairment charges in future periods, which could have a significant impact on

our consolidated financial statements.

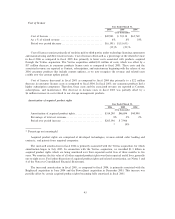

We assess the impairment of acquired product rights and other identifiable intangible assets whenever

events or changes in circumstances indicate that an asset's carrying amount may not be recoverable. An

impairment loss would be recognized when the sum of the estimated future cash flows expected to result from

the use of the asset and its eventual disposition is less than its carrying amount. Such impairment loss would

be measured as the difference between the carrying amount of the asset and its fair value. Our cash flow

assumptions are based on historical and forecasted revenue, operating costs, and other relevant factors. If

management's estimates of future operating results change, or if there are changes to other assumptions, the

estimate of the fair value of our acquired product rights and other identifiable intangible assets could change

significantly. Such change could result in impairment charges in future periods, which could have a significant

impact on our consolidated financial statements.

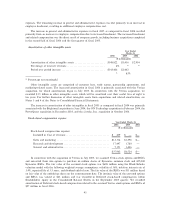

Accounting for Excess Facilities

We have estimated expenses for excess facilities related to consolidating, moving, and relocating

personnel or sites as a result of restructuring activities and business acquisitions. In determining our estimates,

we obtain information from third party leasing agents to calculate anticipated third party sublease income and

the vacancy period prior to finding a sub-lessee. Market conditions may affect our ability to sublease facilities

on terms consistent with our estimates. Our ability to sublease facilities on schedule or to negotiate lease terms

resulting in higher or lower sublease income than estimated may affect our accrual for site closures. In

addition, differences between estimated and actual related broker commissions, tenant improvements, and

related exit costs may increase or decrease our accrual upon final negotiation. If we made different estimates

regarding these various components of our excess facilities costs, the amount recorded for any period presented

could vary materially from those actually recorded.

35