Symantec 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We believe that these foreign exchange forward contracts do not subject us to undue risk from the

movement of foreign exchange rates because gains and losses on these contracts are offset by losses and gains

on the underlying assets and liabilities. All contracts have a maturity of no more than 35 days. Gains and

losses are accounted for as Interest and other income, net each period. We regularly review our hedging

program and may make changes as a result of this review.

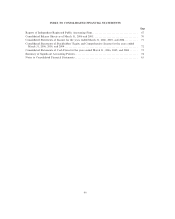

Item 8. Financial Statements and Supplementary Data

Annual Financial Statements

The consolidated financial statements and related disclosures included in Part IV, Item 15 of this annual

report are incorporated by reference into this Item 8.

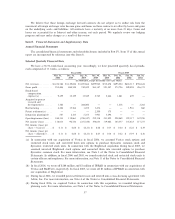

Selected Quarterly Financial Data

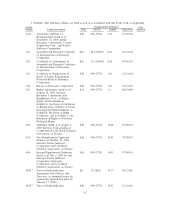

We have a 52/53-week fiscal accounting year. Accordingly, we have presented quarterly fiscal periods,

each comprised of 13 weeks, as follows:

Fiscal 2006 Fiscal 2005

Mar. 31, Dec. 31, Sep. 30, Jun. 30, Mar. 31, Dec. 31, Sep. 30, Jun. 30,

2006 2005 2005 2005 2005 2004 2004 2004

(In thousands, except net income (loss) per share)

Net revenuesÏÏÏÏÏÏÏÏÏÏÏ $1,238,560 $1,149,026 $1,055,864 $699,942 $712,678 $695,224 $618,313 $556,634

Gross profit ÏÏÏÏÏÏÏÏÏÏÏÏ 955,406 880,548 742,422 583,147 591,547 573,726 509,094 456,373

Stock-based

compensation

expense(a) ÏÏÏÏÏÏÏÏÏÏ 9,459 12,329 13,389 2,785 2,844 1,041 639 Ì

Acquired in-process

research and

development(b) ÏÏÏÏÏÏ 1,100 Ì 284,000 Ì Ì 1,218 Ì 2,262

Restructuring ÏÏÏÏÏÏÏÏÏÏ 4,426 15,566 1,452 3,474 Ì Ì 1,916 860

Patent settlement(c) ÏÏÏÏ Ì Ì Ì 2,200 375ÌÌÌ

Integration planning(d) ÏÏ 587 2,185 5,253 7,901 3,494 Ì Ì Ì

Operating income (loss) ÏÏ 180,333 119,661 (258,347) 232,318 231,822 228,069 192,117 167,258

Net income (loss) ÏÏÏÏÏÏ 118,813 90,734 (251,328) 198,633 119,682 163,577 135,623 117,277

Net income (loss) per

share Ì basic(e) ÏÏÏÏÏ $ 0.11 $ 0.08 $ (0.21) $ 0.28 $ 0.17 $ 0.24 $ 0.22 $ 0.19

Net income (loss) per

share Ì diluted(e)ÏÏÏÏ $ 0.11 $ 0.08 $ (0.21) $ 0.27 $ 0.16 $ 0.22 $ 0.19 $ 0.16

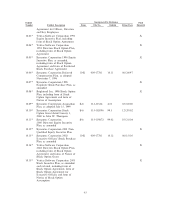

(a) In connection with our acquisition of Veritas in fiscal 2006, we assumed Veritas stock options and

restricted stock units and converted them into options to purchase Symantec common stock and

Symantec restricted stock units. In connection with the Brightmail acquisition during fiscal 2005, we

assumed unvested Brightmail stock options and converted them into unvested options to purchase

Symantec common stock. For more information, see Note 3 of the Notes to Consolidated Financial

Statements. In addition, in fiscal 2006 and 2005, we issued restricted stock and restricted stock units to

certain officers and employees. For more information, see Note 11 of the Notes to Consolidated Financial

Statements.

(b) In fiscal 2006, we wrote off $284 million and $1 million of IPR&D in connection with our acquisitions of

Veritas and BindView, respectively. In fiscal 2005, we wrote off $3 million of IPR&D in connection with

our acquisition of Brightmail.

(c) During fiscal 2006, we recorded patent settlement costs and entered into a cross-licensing agreement with

Altiris, Inc. For more information, see Note 4 of the Notes to Consolidated Financial Statements.

(d) During fiscal 2006, we acquired Veritas. In connection with this acquisition, we recorded integration

planning costs. For more information, see Note 3 of the Notes to Consolidated Financial Statements.

57