Symantec 2006 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2006 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements Ì (Continued)

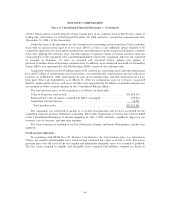

of $12.5 billion and was valued using the average closing price of our common stock of $25.87 over a range of

trading days (December 14, 2004 through December 20, 2004, inclusive) around the announcement date

(December 16, 2004) of the transaction.

Under the terms of the agreement, we also assumed each outstanding option to purchase Veritas common

stock with an exercise price equal to or less than $49.00 as well as each additional option required to be

assumed by applicable law. Each option assumed was converted into an option to purchase Symantec common

stock after applying the exchange ratio. All other options to purchase shares of Veritas common stock not

exercised prior to the acquisition were cancelled immediately prior to the acquisition and were not converted

or assumed by Symantec. In total, we assumed and converted Veritas options into options to

purchase 66 million shares of Symantec common stock. In addition, we assumed and converted all outstanding

Veritas RSUs into approximately 425,000 Symantec RSUs, based on the exchange ratio.

Acquisition-related costs of $39 million consist of $32 million for accounting, legal, and other professional

fees and $7 million of restructuring costs for severance, associated benefits, outplacement services, and excess

facilities. As of March 31, 2006, substantially all costs for accounting, legal, and other professional fees have

been paid. Total cash expenditures as of March 31, 2006 for restructuring costs for severance, associated

benefits, outplacement services, and excess facilities were approximately $4 million. Acquisition-related costs

are included in Other accrued expenses in the Consolidated Balance Sheets.

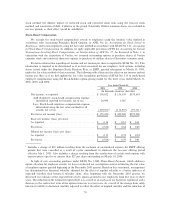

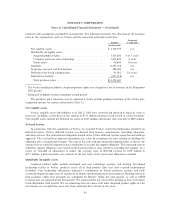

The total purchase price of the acquisition is as follows (in thousands):

Value of Symantec stock issuedÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $12,498,336

Estimated fair value of options assumed and RSUs exchanged ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 698,514

Acquisition related expenses ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 38,791

Total purchase price ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $13,235,641

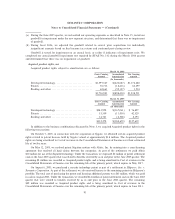

The acquisition was structured to qualify as a tax-free reorganization and we have accounted for the

acquisition using the purchase method of accounting. The results of operations of Veritas have been included

in the Consolidated Statements of Income beginning on July 2, 2005 and had a significant impact on our

revenues, cost of revenues, and operating expenses.

The Veritas business is included in our Data Protection, Storage and Server Management, and Services

segments.

Purchase price allocation

In accordance with SFAS No. 141, Business Combinations, the total purchase price was allocated to

Veritas' net tangible and intangible assets based on their estimated fair values as of July 2, 2005. The excess

purchase price over the value of the net tangible and identifiable intangible assets was recorded as goodwill.

The fair values assigned to tangible and intangible assets acquired and liabilities assumed are based on

84