Shaw 2013 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.S

haw

C

ommunications Inc

.

N

O

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

August 31, 2013 and 201

2

[all amounts in millions of Canadian dollars exce

p

t share and

p

er share amounts

]

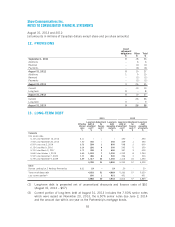

Cor

p

orat

e

Ba

nk l

oa

n

s

D

uring 2012, a syndicate of banks provided the Company with an unsecured

$

1 billion credi

t

f

acilit

y

which includes a maximum revolvin

g

term or swin

g

line facilit

y

of

$

50 and matures in

J

anuar

y 201

7. The cred

i

t

f

ac

i

l

i

t

y

has a

f

eature whereb

y

the

C

om

p

an

y

ma

y

re

q

uest an add

i

t

i

ona

l

$

500 of borrowing capacity so long as no event of default or pending event of default has

o

ccurred and is continuing or would occur as a result of the increased borrowings. No lende

r

h

as an

y

obl

ig

at

i

on to

p

art

i

c

ip

ate

i

n the re

q

uested

i

ncrease unless

i

ta

g

rees to do so at

i

ts sol

e

d

iscretion. This facility replaced the prior credit and operating loan facilities which were

scheduled to mature in May 2012. Funds are available to the Company in both Canadian an

d

U

S dollars. At Au

g

ust 31, 2013, $1 has been drawn as committed letters of credit a

g

ainst th

e

revolv

i

ng term

f

ac

i

l

i

ty. Interest rates

f

luctuate w

i

th

C

anad

i

an pr

i

me and bankers’ acceptance

rates, US bank base rates and LIBOR rates. Excluding the revolving term facility, the effectiv

e

i

nterest rate on actual borrow

i

n

g

s under the cred

i

t

f

ac

i

l

i

t

y

dur

i

n

g 2013

was

3

.4

9% (2012 –

ni

l

)

. The e

ff

ect

i

ve

i

nterest rate on the revolv

i

ng term

f

ac

i

l

i

ty

f

or

2013

was

3% (2012

–

3%)

.

S

enior note

s

The sen

i

or notes are unsecured obl

ig

at

i

ons and rank e

q

uall

y

and ratabl

y

w

i

th all ex

i

st

i

n

g

an

d

f

uture sen

i

or

i

ndebtedness. The notes are redeemable at the

C

ompany’s opt

i

on at any t

i

me,

in

whole or in part, prior to maturity at 100% of the principal amount plus a make-whol

e

p

rem

i

um

.

Other

B

urrard Landin

g

Lot 2 Holdin

g

s Partnershi

p

The Company has a 33.33% interest in the Partnership which built the Shaw Tower project

with office/retail s

p

ace and livin

g

/workin

g

s

p

ace in Vancouver, BC. In the fall of 2004, the

commerc

i

al construct

i

on o

f

the bu

i

ld

i

n

g

was com

p

leted and at that t

i

me, the Partnersh

ip i

ssue

d

t

en year secured mortgage bonds in respect of the commercial component of the Shaw Tower

.

The bonds bear interest at 6.31% com

p

ounded semi-annuall

y

and are collateralized b

y

the

p

ro

p

ert

y

and the commerc

i

al rental

i

ncome

f

rom the bu

i

ld

i

n

g

w

i

th no recourse to the

C

om

p

an

y

.

D

e

b

t covenant

s

The Com

p

an

y

and its subsidiaries have undertaken to maintain certain covenants in res

p

ect of

t

he cred

i

ta

g

reements and trust

i

ndentures descr

i

bed above. The

C

om

p

an

y

and

i

ts subs

i

d

i

ar

i

e

s

were in compliance with these covenants at August 31, 2013

.

93