Shaw 2013 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

N

O

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

August 31, 2013 and 201

2

[all amounts in millions of Canadian dollars exce

p

t share and

p

er share amounts

]

29

.

CO

N

SO

LIDATED

S

TATEMENT

SO

F

C

A

S

HFL

O

W

S

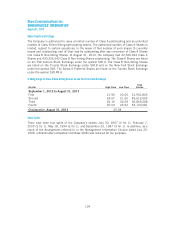

Additional disclosures with res

p

ect to the Consolidated Statements of Cash Flows are a

s

fo

ll

o

w

s:

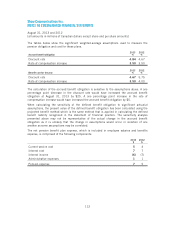

(i)

Funds

f

low

f

rom o

p

erat

i

on

s

2013 2012

$

$

N

et i

n

co

m

e

7

84

7

61

A

djustments to reconcile net income to funds flow from operations

:

A

m

o

r

ti

z

ation

858

813

Program rights

(

31)

(

42)

De

f

erred

i

ncome tax expense

(

recovery

)

121

(

4

3)

C

RTC benefit obli

g

ation

s

[

note 3]

–

2

C

RT

C

bene

fi

t obl

i

gat

i

on

f

und

i

ng

(

5

2)

(

4

8)

G

a

i

n on sale o

f

cables

y

stem

[

note

3]

(

5

0)

–

Divestment cost

s

[note 3

]

5

–

Gai

n

o

n

sa

l

e of associate

[

note

3]

(

7

)

–

Gain on remeasurement of interests in equity investment

s

[note 3]

–

(

6)

S

hare-based com

p

ensat

i

on

4

5

Defined benefit pension plan

s

(288)

(

13)

Gai

n

o

n

de

r

i

v

ati

v

ei

n

st

r

u

m

e

n

ts

–

(1)

Realized loss on settlement of derivative instruments

–

(

7

)

A

ccret

i

on o

f

long-term l

i

ab

i

l

i

t

i

es and prov

i

s

i

ons

9

14

S

ettlement o

f

amended cross-currenc

yi

nterest rate a

g

reement

s

–

(162)

Write-down of properties

[

note 22]

14

2

0

Ot

h

er

13

6

Funds

f

low

f

rom o

p

erat

i

on

s

1

,

380

1,299

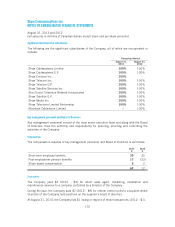

(

ii) Interest and income taxes paid and interest and distributions received and classified as

op

eratin

g

activities are as follows:

2

013 201

2

$

$

Interest

p

aid

3

1

7

33

1

Income taxes pai

d

15

421

8

Interest rece

i

ved

2

3

Distributions receive

d

2

–

120