Shaw 2013 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

N

O

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

August 31, 2013 and 201

2

[all amounts in millions of Canadian dollars exce

p

t share and

p

er share amounts

]

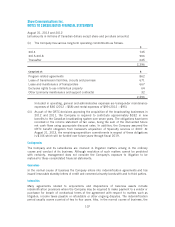

Other benefit

p

lans

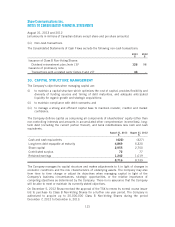

The Company has post employment benefits plans that provide post retirement health and lif

e

insurance covera

g

e to certain retirees in the media business and are funded on a

p

a

y

-as-

y

ou-

g

o

bas

i

s. The table below shows the chan

g

e

i

n the accrued

p

ost-ret

i

rement obl

ig

at

i

on wh

i

ch

i

s

recognized in the statement of financial position

.

2013

$

2012

$

A

ccrued benefit obligation, beginning of yea

r

19 16

Cu

rr

e

n

tse

rv

ice cost

–

–

Interest cost

1

1

Pa

y

ment o

f

bene

fi

ts to em

p

lo

y

ee

s

(1)

(1)

Remeasurements:

E

ff

ect o

f

changes

i

n demograph

i

c assumpt

i

on

s

(

4

)

–

Effect of chan

g

es in financial assum

p

tions

–

3

A

ccrued benefit obli

g

ation and

p

lan deficit, end of

y

ea

r

1

5

19

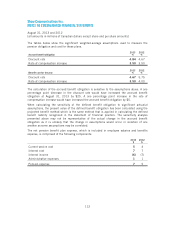

The we

i

ghted average durat

i

on o

f

the bene

fi

t obl

i

gat

i

on at August

31

,

2013 i

s

16

.

9

years

.

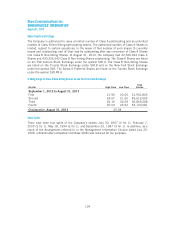

The post-ret

i

rement bene

fi

t plan expense, wh

i

ch

i

s

i

ncluded

i

n employee salar

i

es and bene

fi

ts

expense, is

$

1 (2012 –

$

1) and is comprised of interest cost.

The discount rates used to measure the post-retirement benefit cost for the year and th

e

accrued bene

fi

t obl

ig

at

i

on as at Au

g

ust

31

,

2013

were 4.5

0%

and 4.75

%

, res

p

ect

i

vel

y

(2012

– 5.5

0%

and 4.5

0%

, respect

i

vely

)

. A one percentage po

i

nt decrease

i

n the d

i

scount rat

e

would have increased the accrued benefit obligation at August 31, 2013 by

$

3

.

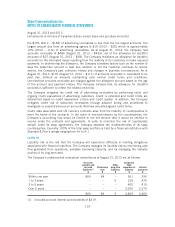

E

m

pl

oyer contr

ib

ut

i

ons

The Company’s estimated contributions to the defined benefit plans in fiscal 2014 are $28

.

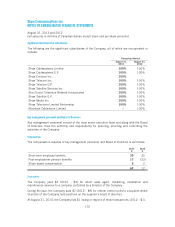

27. RELATED PARTY TRAN

S

A

C

TI

O

N

S

C

ontrolling shareholder

The ma

j

or

i

t

y

o

f

the

C

lass A

S

hares are held b

y

JR

S

haw, members o

f

h

i

s

f

am

i

l

y

and th

e

companies owned and/or controlled by them (the “Shaw Family Group”). All of the Class A

Shares held b

y

the Shaw Famil

y

Grou

p

are sub

j

ect to a votin

g

trust a

g

reement entered into b

y

such

p

ersons. The

S

haw Fam

i

l

yG

rou

pi

sre

p

resented as D

i

rectors,

S

en

i

or Execut

i

ve an

d

Corporate Officers of the Company.

D

uring the year, the Company and the Shaw Family Group formed a partnership to make equit

y

investments in com

p

anies with new and emer

g

in

g

technolo

g

ies that have the

p

otential t

o

p

rovide future benefit to Shaw. The Shaw Famil

y

Grou

p

contributed $1 for its 20% interest in

t

he partnership.

11

4