Shaw 2013 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

N

O

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

August 31, 2013 and 201

2

[all amounts in millions of Canadian dollars exce

p

t share and

p

er share amounts

]

Defined benefit

p

ension

p

lan

s

The

C

om

p

an

y

has two non-re

gi

stered ret

i

rement

p

lans

f

or des

ig

nated execut

i

ves and sen

i

o

r

execut

i

ves and several reg

i

stered pens

i

on plans

f

or certa

i

n employees

i

n the med

i

a bus

i

ness.

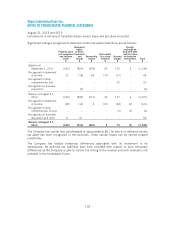

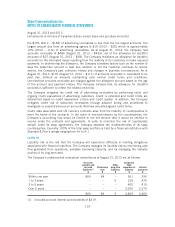

The following is a summary of the accrued benefit liabilities recognized in the statement of

fi

nanc

i

al

p

os

i

t

i

on

.

2013

$

2012

$

Unre

gi

stered

p

lans

A

ccrued benefit obligation 40

6

378

Fair value of

p

lan asset

s

302 –

10

4

378

Re

gi

stered

p

lans

A

ccrued bene

fi

t obl

i

gat

i

o

n

152

1

4

9

Fair value of plan asset

s

133 116

19

33

Acc

r

ued be

n

efit

l

iabi

l

ities a

n

d deficit

123

411

The

p

lans ex

p

ose the

C

om

p

an

y

to a number o

f

r

i

sks, o

f

wh

i

ch the most s

ig

n

ifi

cant are as

fo

ll

o

w

s:

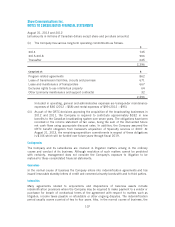

(

i) Volatilit

y

in market conditions: The accrued benefit obli

g

ations are calculated usin

g

di

scount rates w

i

th re

f

erence to bond

yi

elds closel

y

match

i

n

g

the term o

f

the est

i

mate

d

c

ash flows while many of the assets are invested in other types of assets. If plan asset

s

under

p

erform these

y

ields, this will result in a deficit. Chan

g

in

g

market conditions in

c

on

j

unct

i

on w

i

th d

i

scount rate volat

i

l

i

t

y

w

i

ll result

i

n volat

i

l

i

t

y

o

f

the accrued bene

fit

l

iabilities. To minimize some of the investment risk, the Company has established long-

term fundin

g

tar

g

ets where the time horizon and risk tolerance are s

p

ecified.

(ii) S

elect

i

on o

f

account

i

ng assumpt

i

ons: The calculat

i

on o

f

the accrued bene

fi

t obl

i

gat

i

on

s

i

nvolves projecting future cash flows of the plans over a long time frame. This means tha

t

assum

p

t

i

ons used can have a mater

i

al

i

m

p

act on the statements o

ffi

nanc

i

al

p

os

i

t

i

on an

d

c

omprehens

i

ve

i

ncome because

i

n pract

i

ce,

f

uture exper

i

ence o

f

the plans may not be

i

n

l

ine with the selected assumptions.

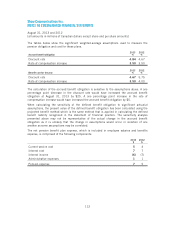

N

on-reg

i

stere

d

pens

i

on p

l

an

s

The

C

om

p

an

yp

rov

i

des a su

pp

lemental execut

i

ve ret

i

rement

p

lan

(“S

ERP”

)f

or certa

i

no

fi

ts

senior executives. Benefits under this plan are based on the employees’ length of service an

d

t

heir hi

g

hest three-

y

ear avera

g

e rate of eli

g

ible

p

ensionable earnin

g

s durin

g

their

y

ears o

f

serv

i

ce. In

2012

, the

C

om

p

an

y

closed the

p

lan to new

p

art

i

c

ip

ants and amended the

p

lan t

o

f

reeze base salary levels at August 31, 2012 for purposes of determining eligible pensionabl

e

earnin

g

s which resulted in a

g

ain of

$

25 in res

p

ect of

p

ast service ad

j

ustments. The

p

lan wa

s

also amended to

p

rov

i

de

f

und

i

n

g

o

f

u

p

to

90%

o

f

the accrued bene

fi

t obl

ig

at

i

on over a

p

er

i

od o

f

six years. Employees are not required to contribute to this plan. During 2013, the plan becam

e

p

artiall

y

funded as the Com

p

an

y

made contributions of

$

300 to a Retirement Com

p

ensatio

n

Arran

g

ement Trust

(“

R

C

A”

)

.

109