Shaw 2013 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

MANA

G

EMENT’

S

DI

SCUSS

I

O

N AND ANALY

S

I

S

August

31

,

2013

up

com

i

n

gfi

scal

y

ear.

O

n a lon

g

er-term bas

i

s,

S

haw ex

p

ects to

g

enerate

f

ree cash

f

low and have

borrowing capacity sufficient to finance foreseeable future business plans and refinanc

e

m

aturing debt.

Debt structure and

f

inancial polic

y

S

haw structures

i

ts borrow

i

n

g

s

g

enerall

y

on a stand-alone bas

i

s. The borrow

i

n

g

so

fS

haw are

u

nsecured. Wh

i

le certa

i

n non-wholly owned subs

i

d

i

ar

i

es are sub

j

ect to contractual restr

i

ct

i

ons

which may prevent the transfer of funds to Shaw, there are no similar restrictions with respect

t

o wholl

y

-owned subs

i

d

i

ar

i

es o

f

the

C

om

p

an

y.

S

haw’s borrow

i

n

g

s are sub

j

ect to covenants wh

i

ch

i

nclude ma

i

nta

i

n

i

n

g

m

i

n

i

mum or max

i

mu

m

fi

nanc

i

al rat

i

os. At August

31

,

2013

,

S

haw

i

s

i

n compl

i

ance w

i

th these covenants and based on

current business plans, the Company is not aware of any condition or event that would give ris

e

t

o non-com

p

l

i

ance w

i

th the covenants over the l

if

eo

f

the borrow

i

n

g

s. As at Au

g

ust

31

,

2013,

t

he rat

i

oo

f

debt to operat

i

ng

i

ncome be

f

ore amort

i

zat

i

on

f

or the

C

orporat

i

on

i

s

2

.

3

t

i

mes

.

H

av

i

ng regard to preva

i

l

i

ng compet

i

t

i

ve, operat

i

onal and cap

i

tal market cond

i

t

i

ons, the Board o

f

D

irectors has determined that having this ratio in the range of 2.0 to 2.5 times would be

op

t

i

mal levera

g

e

f

or the

C

or

p

orat

i

on

i

n the current env

i

ronment.

S

hould the rat

i

o

f

all below th

i

s

t

he Board may choose to recap

i

tal

i

ze back

i

nto th

i

s opt

i

mal range. The Board may also

d

etermine to increase the Corporation’s debt above these levels to finance specific strategi

c

opp

ortun

i

t

i

es such as a s

ig

n

ifi

cant ac

q

u

i

s

i

t

i

on or re

p

urchase o

fC

lass B Non-Vot

i

n

g

P

art

i

c

i

pat

i

ng

S

hares

i

n the event that pr

i

c

i

ng levels were to drop prec

i

p

i

tously

.

Off-balance sheet arran

g

ement and

g

uarantee

s

G

uarantee

s

Generall

y

it is not the Com

p

an

y

’s

p

olic

y

to issue

g

uarantees to non-controlled affiliates or third

p

art

i

es; however,

i

t has entered

i

nto certa

i

na

g

reements as more

f

ull

y

descr

i

bed

i

n Note

2

5t

o

t

he Consolidated Financial Statements. As disclosed thereto, Shaw believes it is remote tha

t

t

hese a

g

reements would re

q

uire an

y

cash

p

a

y

ment

.

C

ontractual obl

ig

at

i

on

s

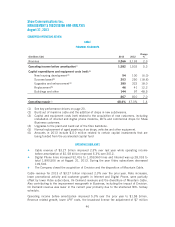

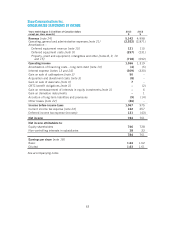

The amounts of estimated future payments under the Company’s contractual obligations at

August 31, 2013 are detailed in the following table.

CO

NTRA

C

TUAL

O

BLI

G

ATI

O

N

S

P

ayments due by period

(

In

$

millions Cdn) Tota

l

W

ithi

n

1

year 2 – 3 years 4 – 5 years

More than

5

year

s

Long-term debt(1

)

8,

328 1

,

241 793 815 5

,

479

O

perat

i

ng obl

i

gat

i

ons

(2)

2

,

296

745 5

83 323 6

45

Purchase obli

g

ations

(

3)

1

62 157 2 2 1

O

ther obligations

(

4

)

53

4

85

––

10

,

839 2

,

191 1

,

383 1

,

1

4

06

,

12

5

(1) Includes principal repayments and interest payments.

54