Shaw 2013 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.S

haw

C

ommunications Inc

.

MANA

G

EMENT’

S

DI

SCUSS

I

O

N AND ANALY

S

I

S

August

31

,

2013

D

ur

i

n

g

the current

y

ear, the

C

om

p

an

y

closed the sale o

f

Mounta

i

n

C

able

i

n Ham

i

lton,

O

ntar

i

ot

o

R

ogers. The Company received proceeds, after working capital adjustments, of

$

398 million

and recorded a gain of

$

50 million

.

The Company incurred

$

8 million of costs in respect of the acquisition of Envision and the

t

ransact

i

ons w

i

th Ro

g

ers related to the sale o

f

Mounta

i

n

C

able,

g

rant o

f

an o

p

t

i

on to ac

q

u

i

re th

e

wireless spectrum licenses and purchase from Rogers of its interest in TVtropolis.

D

uring the current year, the Company recorded a gain of

$

7 million on the sale of its interest i

n

ABC Spark to Corus

.

As part of the CRTC decisions approving the acquisition of Mystery and The Cave during 2012

,

t

he Com

p

an

y

is re

q

uired to contribute a

pp

roximatel

y

$2 million in new benefits to the Canadian

broadcasting system over seven years. Most of this contribution will be used to create new

p

ro

g

rammin

g

on Shaw Media services. The fair value of the obli

g

ation of

$

2 million wa

s

d

eterm

i

ned b

y

d

i

scount

i

n

gf

uture net cash

f

lows us

i

n

g

a

pp

ro

p

r

i

ate d

i

scount rates and has been

r

eco

r

ded

in

t

h

e

in

co

m

e state

m

e

n

t.

The Company recorded a

$

6 million gain in respect of a remeasurement to fair value of th

e

Company’s 50% interest in Mystery and 49% interest in The Cave which were held prior to th

e

ac

q

u

i

s

i

t

i

on on Ma

y31

,

2012

. The

f

a

i

r value o

f

the

C

om

p

an

y

’s e

q

u

i

t

yi

nterest

i

n these s

p

ec

i

alt

y

channels held prior to the acquisition was

$

19 million compared to a carrying value of

$

13

m

illion

.

F

or derivative instruments where hedge accounting is not permissible or derivatives are not

d

es

ig

nated

i

n a hed

gi

n

g

relat

i

onsh

ip

, the

C

om

p

an

y

records chan

g

es

i

n the

f

a

i

r value o

f

de

r

i

v

ati

v

ei

n

st

r

u

m

e

n

ts i

n

t

h

ei

n

co

m

e state

m

e

n

t.

The Company records accretion expense in respect of the discounting of certain long-ter

m

liabilities and

p

rovisions which are accreted to their estimated value over their res

p

ective terms

.

The ex

p

ense

i

s

p

r

i

mar

i

l

yi

n res

p

ect o

fC

RT

C

bene

fi

t obl

ig

at

i

ons

.

O

ther losses

g

enerall

yi

ncludes real

i

zed and unreal

i

zed

f

ore

ig

n exchan

g

e

g

a

i

ns and losses on U

S

d

ollar denominated current assets and liabilities, gains and losses on disposal of property, plan

t

and equipment and minor investments, and the Company’s share of the operations of Burrar

d

L

and

i

n

g

Lot

2

Hold

i

n

g

s Partnersh

ip

. Dur

i

n

g

the

p

r

i

or

y

ear, the cate

g

or

y

also

i

ncluded a

p

ens

i

on

recovery of

$

25 million which arose due to a plan amendment to freeze base salary levels, and

a loss of

$

26 million related to an electrical fire and resulting water damage to Shaw Court. The

loss of $26 million included $6 million of costs in res

p

ect of restoration and recover

y

activities

,

including amounts incurred in the relocation of employees, and an asset write-down of

$

2

0

m

illion related to the damages sustained to the building and its contents. During the curren

t

y

ear, the Com

p

an

y

received insurance advances of $5 million related to its claim for costs tha

t

were incurred in 2012 and incurred additional costs of

$

13 million in respect of ongoin

g

recovery activities. In addition, during the current year the Company decided to discontinu

e

f

urther construction on a real estate

p

ro

j

ect which resulted in a write-down of $14 million.

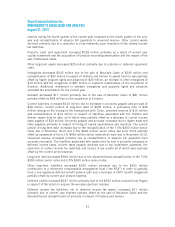

Income tax expens

e

The income tax expense was calculated using current statutory income tax rates of 25.9% for

2013

and

26

.

3% f

or

2012

and was ad

j

usted

f

or the reconc

i

l

i

n

gi

tems

i

dent

ifi

ed

i

n Note

23

t

o

t

h

eCo

n

so

li

dated

Fin

a

n

c

i

a

l

State

m

e

n

ts.

44