Shaw 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

N

O

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

August 31, 2013 and 201

2

[all amounts in millions of Canadian dollars exce

p

t share and

p

er share amounts

]

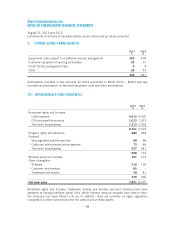

F

ood Network Canada and ABC S

p

ar

k

The ac

q

u

i

s

i

t

i

on o

f

an add

i

t

i

onal

20% i

nterest

i

n Food Network

C

anada

i

ncreased the

C

om

p

an

y

’s

o

wnership to 71%. The difference between the consideration of

$

67 and carrying value of the

interest acquired of

$

47 has been charged to retained earnings.

The Company recorded proceeds, including working capital adjustments, of

$

19 and gain on

sale of associate of

$

7 on the disposition of its 49% interest in ABC Spark.

The Company issued a non-interest bearing promissory note of

$

48 to satisfy the ne

t

consideration in respect of these transactions. The settlement of the promissory note, which

came due on

S

e

p

tember

30

,

2013

, has been extended to the clos

i

n

g

date o

f

the

C

om

p

an

y

’s

sa

l

eof

H

isto

r

ia a

n

dSe

r

ies

+

to Co

r

us.

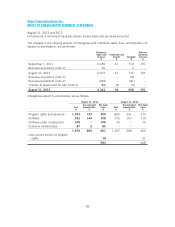

H

istoria and

S

eries

+

H

istoria and Series+ represent a disposal group within the media segment and accordingly, ar

e

n

ot

p

resented as discontinued o

p

erations in the statement of income. The assets and liabilities

associated

w

it

hH

isto

r

ia a

n

dSe

r

ies

+

a

n

dc

l

assified as

h

e

l

dfo

r

sa

l

ei

n

t

h

e state

m

e

n

toffi

n

a

n

cial

position at August 31, 2013 are as follows:

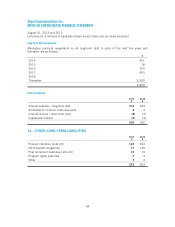

$

A

ccounts receivabl

e

4

Ot

h

e

r

cu

rr

e

n

t assets

5

Intangibles

9

2

Good

w

i

l

l

4

105

A

ccounts

p

a

y

able and accrued l

i

ab

i

l

i

t

i

es

2

Deferred income tax liabilit

y

12

14

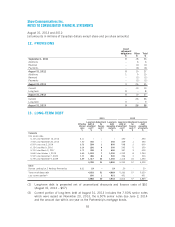

Discontinued o

p

eration

s

D

ur

i

n

g

late

2011

, the

C

om

p

an

y

d

i

scont

i

nued

i

ts w

i

reless o

p

erat

i

ons. The decrease

i

n cash

f

rom

d

iscontinued operations in 2012 of $3 was comprised of cash used in investing activities.

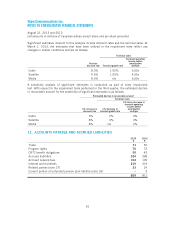

4

.A

CCOU

NT

S

RE

C

EIVABLE

2

01

3

$

2

01

2

$

S

ubscr

i

ber and trade rece

i

vable

s

496

436

Due from related partie

s

[note 27

]

1

1

M

isce

ll

a

n

eous

r

ecei

v

ab

l

es

16

2

4

51

3

4

61

L

ess a

ll

o

w

a

n

ce

f

o

r

doubt

f

u

l

accou

n

ts

(27) (28

)

486

433

8

4