Shaw 2013 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

MANA

G

EMENT’

S

DI

SCUSS

I

O

N AND ANALY

S

I

S

August

31

,

2013

Fi

nanc

i

ng act

i

v

i

t

i

es

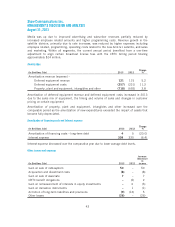

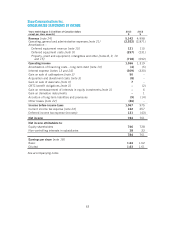

The changes in financing activities during 2013 and 2012 were as follows:

(

In

$

millions Cdn

)

2013 2012

Bank cred

i

t

f

ac

i

l

i

ty arrangement cost

s

–

(

4

)

Re

p

a

y6

.

1% S

en

i

or unsecured notes

(

45

0)

–

Dividend

s

(

332

)

(333

)

D

i

str

i

but

i

ons

p

a

i

d to non-controll

i

n

gi

nterest

s

(19)

(26)

C

ontribution received from non-controlling interes

t

1

–

Issuance o

fC

lass B Non-Vot

i

n

gS

hares

69

17

Repayment of Partnership deb

t

(

1

)

(

1

)

C

ash flow used in financing activities

(

732

)

(

347

)

V

I. LI

Q

UIDITY AND CAPITAL RESOURCE

S

I

n the current

y

ear, the Com

p

an

yg

enerated $604 million of free cash flow. Shaw used its fre

e

cash flow along with cash of

$

5 million, the net proceeds of

$

589 million from the transaction

s

with Ro

g

ers,

p

roceeds on issuance of Class B Non-Votin

g

Shares of

$

69 million and other net

items of $165 million (

p

rimaril

y

in res

p

ect of a reduction in workin

g

ca

p

ital includin

g

curren

t

t

axes on non-operating items) to repay the 6.1%

$

450 million senior notes, fund

$

300 millio

n

in contributions to the RCA in res

p

ect of a non-re

g

istered defined benefit

p

ension

p

lan,

p

a

y

common share dividends of $319 million,

p

urchase Envision for $222 million, invest an

additional net

$

31 million in program rights and fund

$

110 million of accelerated capita

l

s

p

end. Due to timin

g

, the net

p

roceeds from the Ro

g

ers transactions have been tem

p

oraril

y

u

sed

i

non

g

o

i

n

g

o

p

erat

i

ons to the extent the cash was not re

q

u

i

red to

f

und accelerated ca

pi

ta

l

inv

est

m

e

n

ts.

To allow

f

or t

i

mel

y

access to ca

pi

tal markets, the

C

om

p

an

yfi

led a short

f

orm base shel

f

prospectus w

i

th secur

i

t

i

es regulators

i

n

C

anada and the U.

S

. on May

13

,

2013

. The shel

f

prospectus allows for the issue up to an aggregate

$

4 billion of debt and equity securities over

a

2

5 month

p

er

i

od.

On November 20, 2013 the Company repaid the 7.5%

$

350 million senior unsecured notes

.

The

C

om

p

an

y

’s DRIP allows holders o

fC

lass A

S

hares and

C

lass B Non-Vot

i

n

gS

hares who ar

e

res

i

dents o

fC

anada to automat

i

cally re

i

nvest monthly cash d

i

v

i

dends to acqu

i

re add

i

t

i

onal

Class B Non-Voting Shares. Class B Non-Voting Shares distributed under the Company’s DRIP

are new shares

i

ssued

f

rom treasur

y

at a

2%

d

i

scount

f

rom the 5 da

y

we

ig

hted avera

g

e market

pr

i

ce

i

mmed

i

ately preced

i

ng the appl

i

cable d

i

v

i

dend payment date. The DRIP has resulted

i

n

cash savings and incremental Class B Non-Voting Shares of

$

126 million in 2013

.

O

n December 5,

2012 S

haw rece

i

ved the approval o

f

the T

S

X to renew

i

ts normal course

i

ssuer

bid to purchase its Class B Non-Voting Shares for a further one year period. The Company is

author

i

zed to ac

q

u

i

re u

p

to

20

,

000

,

000 C

lass B Non-Vot

i

n

gS

hares dur

i

n

g

the

p

er

i

od

D

ecember 7,

2012

to December

6

,

2013

. No shares were repurchased by the

C

ompany.

At Au

g

ust 31, 2013, the Com

p

an

y

held

$

422 million in cash and had access to

$

1 billion

u

nder

i

ts cred

i

t

f

ac

i

l

i

t

y

. Based on the ava

i

lable cred

i

t

f

ac

i

l

i

t

y

and

f

orecasted

f

ree cash

f

low, th

e

Company expects to have sufficient liquidity to fund operations and obligations during the

53