Shaw 2013 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

N

O

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

August 31, 2013 and 201

2

[all amounts in millions of Canadian dollars exce

p

t share and

p

er share amounts

]

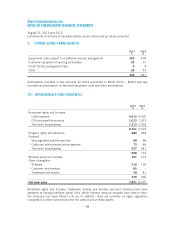

The Company received proceeds of

$

398 in cash on the sale of the Mountain Cable an

d

recorded a

g

ain of $50. The assets and liabilities dis

p

osed of were as follows

:

$

A

ccounts receivabl

e

2

Pro

p

ert

y

,

p

lant and e

q

u

ip

men

t

65

O

ther long-term asset

s

3

Intang

i

bles

2

4

5

Goodwil

l

81

3

96

A

ccounts payable and accrued liabilities

1

I

ncome tax

p

a

y

a

ble

1

Unearned revenue

2

D

efe

rr

ed c

r

edits

2

Deferred income taxe

s

4

2

48

W

ireless s

p

ectrum license

s

The wireless s

p

ectrum licenses are not classified as assets held for sale due to re

g

ulator

y

restr

i

ct

i

ons

p

revent

i

n

g

the exerc

i

se o

f

the o

p

t

i

on and subse

q

uent trans

f

er o

f

the l

i

censes unt

i

l

after September 2014. The Company received

$

50 in respect of the purchase price of the

op

tion to ac

q

uire the wireless s

p

ectrum licenses. The amount is recorded in deferred credits

and w

i

ll be

i

ncluded as

p

art o

f

the

p

roceeds rece

i

ved on exerc

i

se o

f

the o

p

t

i

on and sale o

f

th

e

wireless spectrum licenses, or alternatively as a gain if the option is not exercised and expires

.

I

n addition, the Com

p

an

y

received a

$

200 refundable de

p

osit in res

p

ect of the o

p

tion exercis

e

p

r

i

ce. The de

p

os

i

t has been recorded

i

nde

f

erred cred

i

ts and w

i

ll be

i

ncluded as

p

art o

f

th

e

proceeds received on exercise of the option and sale of the wireless spectrum licenses o

r

refunded to Ro

g

ers if the o

p

tion is not exercised and ex

p

ires

.

TV

tro

p

o

lis

The acquisition of Rogers’ 33.3% interest in TVtropolis increased the Company’s ownership t

o

100%. The difference between the consideration of $59, which was initiall

yp

aid as a de

p

osi

t

pend

i

ng regulatory approval o

f

the transact

i

on, and the carry

i

ng value o

f

the

i

nterest acqu

i

red o

f

$

23 has been charged to retained earnings

.

T

ransactions with

C

orus Entertainment Inc.

(“C

orus”

)

D

uring the current year, the Company entered into a series of agreements with Corus (see not

e

27) to o

p

timize its

p

ortfolio of s

p

ecialt

y

channels. Effective A

p

ril 30, 2013, the Com

p

an

y

sold

t

o

C

orus

i

ts 4

9% i

nterest

i

nAB

CSp

ark and ac

q

u

i

red

f

rom

C

orus

i

ts

20% i

nterest

i

n Foo

d

N

etwork Canada. In addition, the Company has agreed to sell to Corus its 50% interest in it

s

t

wo French-lan

g

ua

g

e channels, Historia and Series+. The sale of Historia and Series+ is

ex

p

ected to occur

i

n

201

4

.

83