Shaw 2013 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.S

haw

C

ommunications Inc

.

N

O

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

August 31, 2013 and 201

2

[all amounts in millions of Canadian dollars exce

p

t share and

p

er share amounts

]

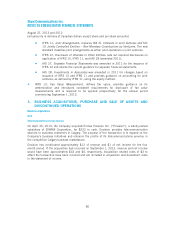

rate. The discount rate is the interest rate used to determine the present value of the futur

e

cash flows that is ex

p

ected will be needed to settle em

p

lo

y

ee benefit obli

g

ations. It is based on

t

he

yi

eld o

f

lon

g

-term, h

ig

h-

q

ual

i

t

y

cor

p

orate

fi

xed

i

ncome

i

nvestments closel

y

match

i

n

g

the

t

erm of the estimated future cash flows and is reviewed and adjusted as changes required

.

(

vi

)

Income taxe

s

The

C

om

p

an

yi

sre

q

u

i

red to est

i

mate

i

ncome taxes us

i

n

g

substant

i

vel

y

enacted tax rates an

d

laws that w

i

ll be

i

ne

ff

ect when the d

iff

erences are expected to reverse. In determ

i

n

i

ng the

m

easurement of tax uncertainties, the Company applies a probable weighted average

m

ethodolo

gy

. Real

i

zat

i

on o

f

de

f

erred

i

ncome tax assets

i

sde

p

endent on

g

enerat

i

n

g

su

ffi

c

i

ent

t

axable income during the period in which the temporary differences are deductible. Although

realization is not assured, management believes it is more likely than not that all recognized

d

e

f

erred

i

ncome tax assets w

i

ll be real

i

zed based on reversals o

f

de

f

erred

i

ncome tax l

i

ab

i

l

i

t

i

es

,

projected operating results and tax planning strategies available to the Company and its

subsidiaries

.

(

vii) Contin

g

encie

s

The

C

ompany

i

s sub

j

ect to var

i

ous cla

i

ms and cont

i

ngenc

i

es related to lawsu

i

ts, taxes an

d

commitments under contractual and other commercial obligations. Contingent losses are

reco

g

n

i

zed b

y

a char

g

eto

i

ncome when

i

t

i

sl

i

kel

y

that a

f

uture event w

i

ll con

fi

rm that an asse

t

h

as been

i

mpa

i

red or a l

i

ab

i

l

i

ty

i

ncurred at the date o

f

the

fi

nanc

i

al statements and the amoun

t

can be reasonably estimated. Significant changes in assumptions as to the likelihood and

est

i

mates o

f

the amount o

f

a loss could result

i

n reco

g

n

i

t

i

on o

f

add

i

t

i

onal l

i

ab

i

l

i

t

i

es

.

C

ritical

j

ud

g

ements

The following are critical judgements apart from those involving estimation

:

(

i

)

Determination of a CG

U

M

ana

g

ement’s

j

ud

g

ement

i

sre

q

u

i

red

i

n determ

i

n

i

n

g

the

C

om

p

an

y

’s cash

g

enerat

i

n

g

un

i

ts

f

o

r

t

he impairment assessment of its indefinite-life intangible assets. The CGUs have been

d

etermined considering operating activities and asset management and are consistent with the

C

om

p

an

y

’s re

p

ort

i

n

g

se

g

ments,

C

able,

S

atell

i

te and Med

i

a

.

(ii)

Broadcast r

i

ghts and l

i

censes and spectrum l

i

censes –

i

nde

fi

n

i

te-l

if

e assessment

The Company’s businesses are dependent upon broadcast licenses (or operate pursuant to a

n

exem

p

t

i

on order

)g

ranted and

i

ssued b

y

the

C

RT

C

. In add

i

t

i

on, the

C

om

p

an

y

holds AW

S

l

i

censes to operate a w

i

reless system

i

n

C

anada. Wh

i

le these l

i

censes must be renewed

f

ro

m

t

ime to time, the Company has never failed to do so. In addition, there are currently no legal

,

re

g

ulator

y

or com

p

et

i

t

i

ve

f

actors that l

i

m

i

t the use

f

ul l

i

ves o

f

these assets

.

Ado

p

tion of recent accountin

gp

ronouncement

s

The Company adopted the following standards and amendments effective September 1, 2012

.

(

i) Em

p

lo

y

ee Benefit

s

I

A

S19

,

E

m

p

lo

y

ee Bene

fi

t

s

(

amended

2011)

,el

i

m

i

nates the ex

i

st

i

n

g

o

p

t

i

on to de

f

er actuar

i

a

l

g

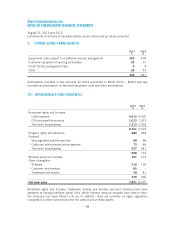

ains and losses and requires changes from the remeasurement of defined benefit plan asset

s

7

8