Shaw 2013 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

N

O

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

August 31, 2013 and 201

2

[all amounts in millions of Canadian dollars exce

p

t share and

p

er share amounts

]

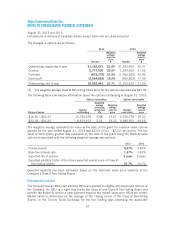

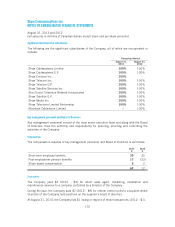

(ii) The Company has various long-term operating commitments as follows

:

$

201

4

745

2015-201

8

9

06

T

h

e

r

eafte

r

6

4

5

2,296

C

om

p

r

i

sed o

f

:

$

Program related agreements

862

Lease of transmission facilities, circuits and

p

remises 671

Lease and ma

i

ntenance o

f

transponders

66

7

Exclus

i

ve r

ig

hts to use

i

ntellectual

p

ro

p

ert

y6

4

O

ther (primarily maintenance and support contracts) 3

2

2

,

296

Included in o

p

eratin

g

,

g

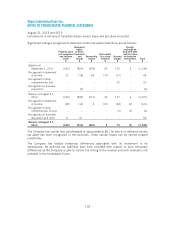

eneral and administrative ex

p

enses are trans

p

onder maintenance

e

x

p

enses of $66 (2012 – $58) and rental ex

p

enses of $99 (2012 – $95)

.

(iii)

As part o

f

the

C

RT

C

dec

i

s

i

ons approv

i

ng the acqu

i

s

i

t

i

on o

f

the broadcast

i

ng bus

i

nesses

i

n

2

012 and 2011, the Company is required to contribute approximately

$

182 in ne

w

b

ene

fi

ts to the

C

anad

i

an broadcast

i

n

g

s

y

stem over seven

y

ears. The obl

ig

at

i

ons have been

recorded

i

n the

i

ncome statement at

f

a

i

r value, be

i

ng the sum o

f

the d

i

scounted

f

utur

e

net cash flows using appropriate discount rates. In addition, the Company assumed the

C

RT

C

bene

fi

t obl

ig

at

i

on

f

rom

C

anwest’s ac

q

u

i

s

i

t

i

on o

fSp

ec

i

alt

y

serv

i

ces

i

n

200

7. At

August

31

,

2013

, the rema

i

n

i

ng expend

i

ture comm

i

tments

i

n respect o

f

these obl

i

gat

i

on

s

i

s

$

146 which will be funded over future years through fiscal 2019.

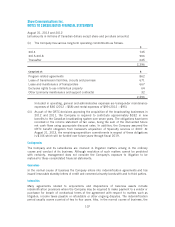

C

ontingencies

The

C

om

p

an

y

and

i

ts subs

i

d

i

ar

i

es are

i

nvolved

i

nl

i

t

ig

at

i

on matters ar

i

s

i

n

gi

n the ord

i

nar

y

course and conduct of its business. Although resolution of such matters cannot be predicted

with certaint

y

, mana

g

ement does not consider the Com

p

an

y

’s ex

p

osure to liti

g

ation to b

e

mate

r

ia

l

to t

h

ese co

n

so

l

idated fi

n

a

n

cia

l

state

m

e

n

ts

.

Guarantees

I

n the normal course of business the Company enters into indemnification agreements and has

i

ssued

i

rrevocable standb

y

letters o

f

cred

i

t and commerc

i

al suret

y

bonds w

i

th and to th

i

rd

p

art

i

es.

Indemnitie

s

M

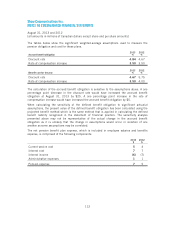

any agreements related to acquisitions and dispositions of business assets include

i

ndemn

ifi

cat

i

on

p

rov

i

s

i

ons where the

C

om

p

an

y

ma

y

be re

q

u

i

red to make

p

a

y

ment to a vendor o

r

purchaser

f

or breach o

f

contractual terms o

f

the agreement w

i

th respect to matters such a

s

litigation, income taxes payable or refundable or other ongoing disputes. The indemnification

p

er

i

od usuall

y

covers a

p

er

i

od o

f

two to

f

our

y

ears. Also,

i

n the normal course o

f

bus

i

ness, th

e

10

7