Shaw 2013 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.S

haw

C

ommunications Inc

.

MANA

G

EMENT’

S

DI

SCUSS

I

O

N AND ANALY

S

I

S

August

31

,

2013

i

ncome tax assets based on

f

orecasts o

f

taxable

i

ncome o

ff

uture

y

ears, ex

i

st

i

n

g

tax laws an

d

t

ax planning strategies. Significant changes in assumptions with respect to internal forecasts o

r

t

he inability to implement tax planning strategies could result in future impairment of these

assets.

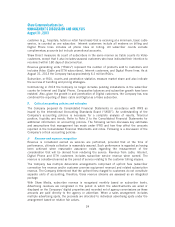

ix) Commitments and contingencie

s

The

C

om

p

an

yi

s sub

j

ect to var

i

ous cla

i

ms and cont

i

n

g

enc

i

es related to lawsu

i

ts, taxes an

d

commitments under contractual and other commercial obligations. Contingent losses are

recognized by a charge to income when it is likely that a future event will confirm that an asse

t

h

as been

i

m

p

a

i

red or a l

i

ab

i

l

i

t

yi

ncurred at the date o

f

the

fi

nanc

i

al statements and the amoun

t

can be reasonably estimated. Contractual and other commercial obligations primarily relate t

o

n

etwork fees, program rights and operating lease agreements for use of transmission facilities

,

i

nclud

i

n

g

ma

i

ntenance o

f

satell

i

te trans

p

onders and lease o

fp

rem

i

ses

i

n the normal course o

f

bus

i

ness.

Si

gn

ifi

cant changes

i

n assumpt

i

ons as to the l

i

kel

i

hood and est

i

mates o

f

the amount

o

f a loss could result in recognition of additional liabilities.

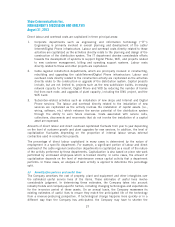

G. Related

p

art

y

transaction

s

R

elated party transact

i

ons are rev

i

ewed by

S

haw’s

C

orporate

G

overnance and Nom

i

nat

i

n

g

Committee, comprised of independent directors. The following sets forth certain transactions in

wh

i

ch the

C

om

p

an

yi

s

i

nvolved

.

C

oru

s

The

C

om

p

an

y

and

C

orus are sub

j

ect to common vot

i

n

g

control. Dur

i

n

g

the

y

ear, network,

advert

i

s

i

ng and programm

i

ng

f

ees were pa

i

d to var

i

ous

C

orus subs

i

d

i

ar

i

es. The

C

ompany

provided uplink of television signals, programming content, Internet services and lease o

f

c

i

rcu

i

ts to var

i

ous

C

orus subs

i

d

i

ar

i

es. In add

i

t

i

on, the

C

om

p

an

yp

rov

i

ded

C

orus w

i

th telev

i

s

i

on

advert

i

s

i

ng spots

i

n return

f

or rad

i

o and telev

i

s

i

on advert

i

s

i

ng.

The Company also entered into a number of transactions with Corus to optimize its portfolio o

f

s

p

ecialt

y

channels. Shaw a

g

reed to sell to Corus its 49% interest in ABC S

p

ark and 50%

i

nterest

i

n

i

ts two French-lan

g

ua

g

e channels, H

i

stor

i

a and

S

er

i

es+. In add

i

t

i

on,

C

orus a

g

reed t

o

sell to Shaw its 20% interest in Food Network Canada. The ABC Spark and Food Networ

k

Canada transactions closed during the year while Historia and Series+ are expected to close i

n

fisca

l

201

4

.

Burrard Landing Lot 2 Holdings Partnershi

p

The

C

om

p

an

y

has a

33

.

33% i

nterest

i

n the Partnersh

ip

. Dur

i

n

g

the current

y

ear, the

C

om

p

an

y

paid the Partnership for lease of office space in Shaw Tower. Shaw Tower, located i

n

V

ancouver, BC, is the Company’s headquarters for its lower mainland operations.

Sp

ecialt

y

channel

s

The Company either currently holds or previously held interests in a number of specialt

y

t

elev

i

s

i

on channels wh

i

ch are e

i

ther sub

j

ect to

j

o

i

nt control or s

ig

n

ifi

cant

i

n

f

luence,

i

nclud

i

n

g

H

istoria and Series+. During the current year the Company paid network fees and provided

u

plink of television signals to these channels

.

Ke

y

mana

g

ement

p

ersonnel and Board of Director

s

K

e

y

mana

g

ement

p

ersonnel consist of the most senior executive team and alon

g

with the Board

of

D

i

rectors have the author

i

t

y

and res

p

ons

i

b

i

l

i

t

yf

or d

i

rect

i

n

g

and controll

i

n

g

the act

i

v

i

t

i

es o

f

30