Shaw 2013 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

MANA

G

EMENT’

S

DI

SCUSS

I

O

N AND ANALY

S

I

S

August

31

,

2013

vi)

Asset

i

m

p

a

i

rmen

t

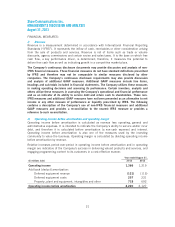

The Company tests goodwill and indefinite-life intangibles for impairment annually (as at

M

arch 1) and when events or changes in circumstances indicate that the carrying value may be

i

m

p

a

i

red. The recoverable amount o

f

each cash-

g

enerat

i

n

g

un

i

t

(“CG

U”

)i

s determ

i

ned base

d

o

n the higher of the CGU’s fair value less costs to sell and its value in use. A CGU is th

e

smallest identifiable

g

rou

p

of assets that

g

enerate cash flows that are inde

p

endent of the cash

i

n

f

lows

f

rom other assets or

g

rou

p

so

f

assets. The

C

om

p

an

y

’s cash

g

enerat

i

n

g

un

i

ts ar

e

consistent with its reporting segments, Cable, Satellite and Media. Where the recoverabl

e

amount of the CGU is less than its carrying amount, an impairment loss is recognized.

I

m

p

a

i

rment losses relat

i

n

g

to

g

oodw

i

ll cannot be reversed

i

n

f

uture

p

er

i

ods. The results o

f

th

e

impairment tests are provided in Note 10 to the Consolidated Financial Statements.

v

ii) Em

p

lo

y

ee benefit

p

lan

s

As at Au

g

ust 31, 2013, Shaw had non-re

g

istered defined benefit

p

ension

p

lans for ke

y

senior

execut

i

ves and des

ig

nated execut

i

ves and var

i

ous re

gi

stered de

fi

ned bene

fi

t

p

lans

f

or certa

in

u

nionized and non-unionized employees. The amounts reported in the financial statement

s

relatin

g

to the defined benefit

p

ension

p

lans are determined usin

g

actuarial valuations that are

based on several assum

p

t

i

ons

i

nclud

i

n

g

the d

i

scount rate and rate o

f

com

p

ensat

i

on

i

ncrease.

W

hile the Company believes these assumptions are reasonable, differences in actual results o

r

chan

g

es in assum

p

tions could affect em

p

lo

y

ee benefit obli

g

ations and the related incom

e

statement

i

m

p

act. The d

iff

erences between actual and assumed results are

i

mmed

i

atel

y

recognized in other comprehensive income/loss. The most significant assumption used t

o

calculate the net em

p

lo

y

ee benefit

p

lan ex

p

ense is the discount rate. The discount rate is the

i

nterest rate used to determ

i

ne the

p

resent value o

f

the

f

uture cash

f

lows that

i

sex

p

ected w

i

ll

be needed to settle employee benefit obligations and is also used to calculate the interest

income on

p

lan assets. It is based on the

y

ield of lon

g

-term, hi

g

h-

q

ualit

y

cor

p

orate fixed income

i

nvestments closel

y

match

i

n

g

the term o

f

the est

i

mated

f

uture cash

f

lows and

i

s rev

i

ewed an

d

adjusted as changes required. The following table illustrates the increase on the accrue

d

benefit obli

g

ation and

p

ension ex

p

ense of a 1% decrease in the discount rate:

A

cc

r

ued

B

e

n

efit

O

bligation a

t

End of Fiscal 201

3

Pension Expens

e

Fiscal 201

3

We

ig

hted Avera

g

eD

i

scount Rate – Non-re

gi

stered Plans 4.75

%

4.4

9%

Weighted Average Discount Rate – Registered Plans 4.84% 4.67%

Im

p

act o

f

:

1%

decreas

e

(

$million

s

)

– Non-re

g

istered Plans $ 68 $

6

Impact o

f

:

1%

decreas

e

($

million

s

)

– Registered Plans

$

25

$

3

v

iii

)

Deferred income taxe

s

The

C

om

p

an

y

has reco

g

n

i

zed de

f

erred

i

ncome tax assets and l

i

ab

i

l

i

t

i

es

f

or the

f

uture

i

ncom

e

t

ax consequences attributable to differences between the financial statement carrying amount

s

o

f assets and liabilities and their res

p

ective tax bases. Deferred tax assets are also reco

g

nized in

res

p

ect o

f

the

C

om

p

an

y

’s losses and losses o

f

certa

i

no

fi

ts subs

i

d

i

ar

i

es. The de

f

erred

i

ncom

e

t

ax assets and liabilities are measured using enacted or substantially enacted tax rates expecte

d

t

oa

pp

l

y

to taxable income in the

y

ears in which the tem

p

orar

y

differences are ex

p

ected t

o

reverse or the tax losses are ex

p

ected to be ut

i

l

i

zed. Real

i

zat

i

on o

f

de

f

erred

i

ncome tax assets

i

s

d

ependent upon generating sufficient taxable income during the period in which the temporary

d

ifferences are deductible. The Com

p

an

y

has evaluated the likelihood of realization of deferre

d

29