Shaw 2013 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

MANA

G

EMENT’

S

DI

SCUSS

I

O

N AND ANALY

S

I

S

August

31

,

2013

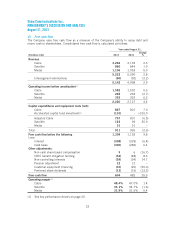

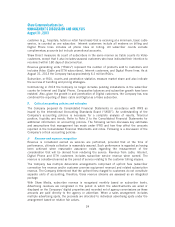

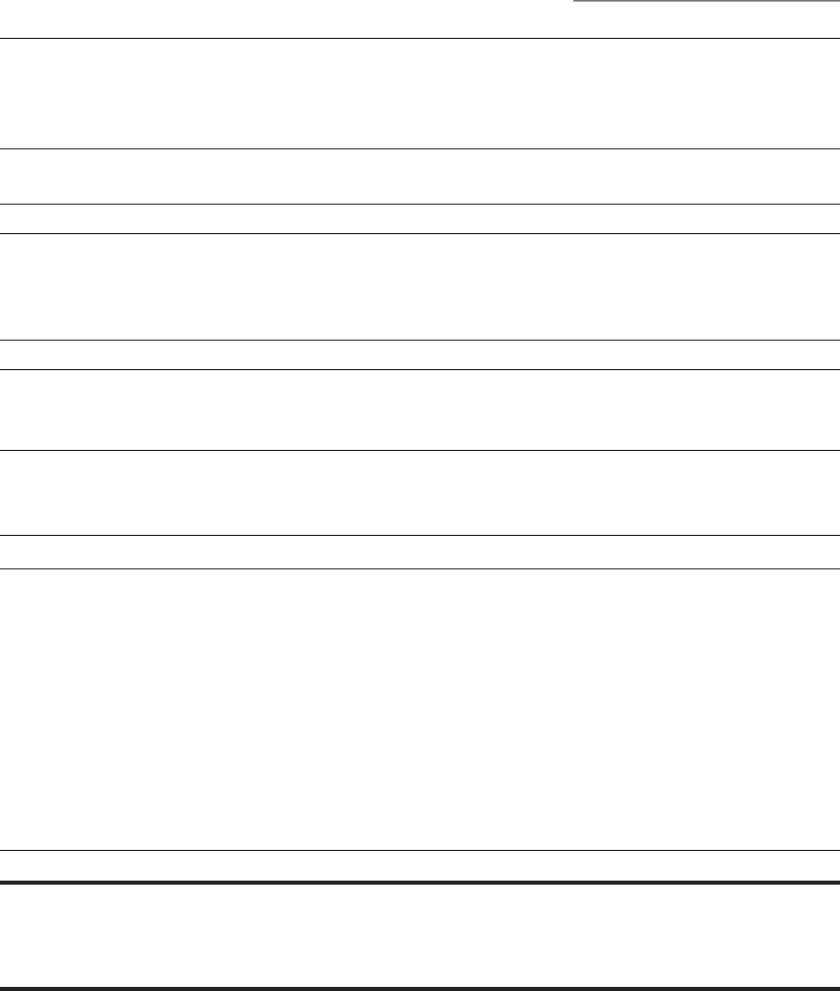

iii)

Free cash

f

low

The Company uses free cash flow as a measure of the Company’s ability to repay debt an

d

return cash to shareholders. Consolidated free cash flow is calculated as follows

:

Year ended August 31

,

(

$millions Cdn) 2013 201

2

C

hange

%

R

evenue

Cabl

e

3

,

266 3

,

193 2.

3

Sate

ll

ite

860

8

44

1

.

9

M

edia

1

,

106

1

,

0

5

3

5.

0

5,

232

5,

090 2.8

Interse

g

ment el

i

m

i

nat

i

on

s

(90)

(92) (2

.

2)

5

,

1

4

2

4

,

998 2

.

9

Operating income before amortization

(

1)

Cab

l

e

1

,5

82

1,

5

02

5.

3

Sate

ll

ite

285

293 (2

.7

)

Medi

a

3

5

3

332 6.

3

2

,

220

2,12

74.

4

Ca

p

ital ex

p

enditures and e

q

ui

p

ment costs (net)

:

Cabl

e

8

67

8

10 7.0

Accelerated ca

p

ital fund investmen

t

(

1)

(

110

)

– >100.

0

Adjusted Cabl

e

7

57

8

10 (6.5)

S

atellite

1

2

3

9

4 30.9

M

edia

31

31 –

T

ota

l

911

9

35 (2.6)

F

ree cash

f

low be

f

ore the

f

ollow

i

n

g1

,

309

1,192 9

.

8

Less:

In

te

r

est

(308)

(329) (6

.4

)

Cash taxe

s

(

300

)

(282) 6.4

Other adjustments:

Non-cash share-based com

p

ensat

i

on

5

6 (16

.7

)

C

RT

C

bene

fi

t obl

ig

at

i

on

f

und

i

n

g

(

5

2)

(

4

8) 8

.

3

Non-controlling interest

s

(

39

)

(34) 14.7

Pension adjustmen

t

12

1

2

–

Customer e

q

ui

p

ment financin

g

(

10

)

(

20

)(

50.0

)

Pr

efe

rr

ed s

h

a

r

edi

v

ide

n

ds

(13)

(1

5

) (13

.

3)

F

ree cash flow 60

4

482 25.

3

Op

erat

i

n

g

mar

gi

n

(1)

Cab

l

e

4

8

.4

%

4

7.

0%

1.4

S

atellite 33.1

%

34.7% (1.6)

Medi

a

31.9

%

31.5% 0.4

(1) S

ee key per

f

ormance dr

i

vers on page

20.

22