Shaw 2013 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

N

O

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

August 31, 2013 and 201

2

[all amounts in millions of Canadian dollars exce

p

t share and

p

er share amounts

]

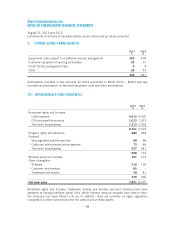

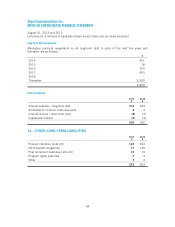

The changes in options are as follows:

2013

2012

Nu

m

be

r

Weighted

a

v

erage

exercis

e

p

r

i

ce

$

Number

Weighte

d

a

v

erage

exercise

p

r

i

ce

$

O

utstanding, beginning of yea

r

2

1,162,672 21.09 21,970,400 20.91

G

r

a

n

ted

2

,777,

000 23

.

07

1,229,000 21

.

05

Forfeited (819

,

375) 21.0

6

(

1,066,925) 20.9

6

Ex

e

r

cised

(1)

(3

,5

6

4,

8

5

6) 19

.

2

4

(969,803) 1

7.

09

O

utstand

i

n

g

, end o

fy

ea

r

19

,555,44

121

.7

1

21,162,6

7

221

.

09

(1) The wei

g

hted avera

g

e Class B Non-Votin

g

Share

p

rice for the o

p

tions exercised was $23.96.

The

f

ollow

i

ng table summar

i

zes

i

n

f

ormat

i

on about the opt

i

ons outstand

i

ng at August

31

,

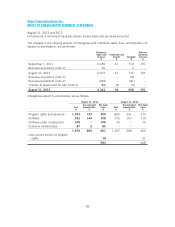

2013:

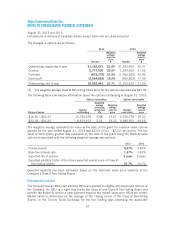

Op

t

i

ons outstand

i

n

g

Op

t

i

ons exerc

i

seable

Ran

g

eo

fp

r

i

ce

s

Nu

m

ber

outstand

i

n

g

W

e

i

ghte

d

avera

ge

r

ema

i

n

i

n

g

co

n

t

r

actual

l

ife

We

ig

hted

a

vera

g

e

e

x

e

r

cise

p

r

i

ce

Nu

m

be

r

e

x

e

r

cisab

l

e

W

e

ig

hte

d

avera

ge

e

x

e

r

cise

p

r

i

c

e

$16.30 – $22.27 10,736,278 5.98 19.57 6,976,778 19.2

0

$

22.28 –

$

26.20 8

,

819

,

163 5.34 24.32 6

,

685

,

663 24.5

5

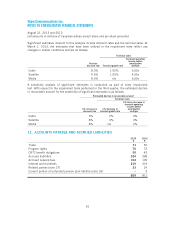

The weighted average estimated fair value at the date of the grant for common share options

g

ranted for the

y

ear ended Au

g

ust 31, 2013 was $2.53 (2012 – $2.72)

p

er o

p

tion. The fai

r

value o

f

each opt

i

on granted was est

i

mated on the date o

f

the grant us

i

ng the Black-

S

choles

o

ption pricing model with the following weighted-average assumptions:

2

013 201

2

Dividend yiel

d

4

.37%

4

.48

%

R

is

k-

f

r

ee i

n

te

r

est

r

ate

1

.

3

7

%

1

.4

2%

Ex

p

ected life of o

p

tions 5 years

5y

ears

Expected volat

i

l

i

ty

f

actor o

f

the

f

uture expected market pr

i

ce o

fC

lass B

Non-Voting Share

s

21.7%

2

4.7

%

E

xpected volatility has been estimated based on the historical share price volatility of the

Com

p

an

y

’s Class B Non-Votin

g

Shares

.

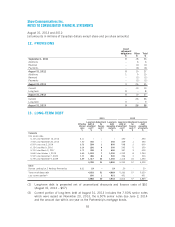

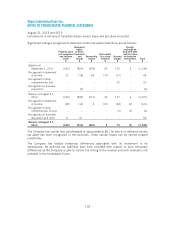

Restricted share unit

p

lan

The Com

p

an

y

has an RSU

p

lan whereb

y

RSUs are

g

ranted to eli

g

ible em

p

lo

y

ees and officers o

f

t

he

C

om

p

an

y

.AnR

S

U

i

sar

ig

ht that tracks the value o

f

one

C

lass B Non-Vot

i

n

gS

hare an

d

permits the holder to receive a cash payment equal to the market value once RSUs are vested

.

M

arket value is determined b

y

the avera

g

e of the closin

gp

rices of the Class B Non-Votin

g

S

hares on the Toronto

S

tock Exchan

g

e

f

or the

fi

ve trad

i

n

g

da

y

s

p

reced

i

n

g

the a

pp

l

i

cabl

e

97