Shaw 2013 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

N

O

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

August 31, 2013 and 201

2

[all amounts in millions of Canadian dollars exce

p

t share and

p

er share amounts

]

t

he

$

196 (2012 –

$

182) of advertising receivables is due from the ten largest accounts. The

lar

g

est amount due from an advertisin

g

a

g

enc

y

is $19 (2012 – $20) which is a

pp

roximatel

y

10% (2012

–

11%)

o

f

advert

i

s

i

n

g

rece

i

vables. As at Au

g

ust

31

,

2013

, the

C

om

p

an

y

ha

d

accounts receivable of

$

486 (August 31, 2012 –

$

433), net of the allowance for doubtful

accounts of $27 (Au

g

ust 31, 2012 – $28). The Com

p

an

y

maintains an allowance for doubtful

accounts

f

or the est

i

mated losses result

i

n

gf

rom the

i

nab

i

l

i

t

y

o

fi

ts customers to make re

q

u

i

red

payments. In determining the allowance, the Company considers factors such as the number of

d

a

y

s the subscriber account is

p

ast due, whether or not the customer continues to receiv

e

serv

i

ce, the

C

om

p

an

y

’s

p

ast collect

i

on h

i

stor

y

and chan

g

es

i

n bus

i

ness c

i

rcumstances. As a

t

August 31, 2013,

$

135 (August 31, 2012 –

$

111) of accounts receivable is considered to be

p

ast due, defined as amounts outstandin

gp

ast normal credit terms and conditions

.

U

ncollect

i

ble accounts rece

i

vable are char

g

ed a

g

a

i

nst the allowance account based on the a

g

e

o

f the account and payment history. The Company believes that its allowance for doubtful

accounts is sufficient to reflect the related credit risk

.

The

C

om

p

an

y

m

i

t

ig

ates the cred

i

tr

i

sk o

f

advert

i

s

i

n

g

rece

i

vables b

yp

er

f

orm

i

n

gi

n

i

t

i

al and

o

ngo

i

ng cred

i

t evaluat

i

ons o

f

advert

i

s

i

ng customers.

C

red

i

t

i

s extended and cred

i

tl

i

m

i

ts are

d

etermined based on credit assessment criteria and credit quality. In addition, the Company

mi

t

ig

ates cred

i

tr

i

sk o

f

subscr

i

ber rece

i

vables throu

g

h advance b

i

ll

i

n

g

and

p

rocedures t

o

d

owngrade or suspend serv

i

ces on accounts that have exceeded agreed cred

i

t terms

.

Credit risks associated with US currency contracts arise from the inability of counterparties t

o

m

eet the terms o

f

the contracts. In the event o

f

non-

p

er

f

ormance b

y

the counter

p

art

i

es, the

C

ompany’s account

i

ng loss would be l

i

m

i

ted to the net amount that

i

t would be ent

i

tled t

o

receive under the contracts and agreements. In order to minimize the risk of counterpart

y

d

e

f

ault under

i

ts swa

p

a

g

reements, the

C

om

p

an

y

assesses the cred

i

tworth

i

ness o

fi

ts swa

p

counterpart

i

es.

C

urrently

100%

o

f

the total swap port

f

ol

i

o

i

s held by a

fi

nanc

i

al

i

nst

i

tut

i

on w

i

th

Standard & Poor’s ratings ranging from A+ to A-1.

L

i

q

uidity ris

k

L

iquidity risk is the risk that the Company will experience difficulty in meeting obligation

s

associated with financial liabilities. The Company manages its liquidity risk by monitoring cas

h

f

low

g

enerated

f

rom o

p

erat

i

ons, ava

i

lable borrow

i

n

g

ca

p

ac

i

t

y

, and b

y

mana

gi

n

g

the matur

i

t

y

pro

fi

les o

fi

ts long-term debt

.

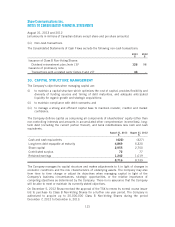

The Company’s undiscounted contractual maturities as at August 31, 2013 are as follows

:

A

ccounts

p

aya

bl

ean

d

acc

r

ued

l

iabi

l

ities

(1

)

P

rom

i

ssor

y

n

ote

O

the

r

l

on

g

-term

liabi

l

ities

L

ong-term

d

e

bt

r

e

p

a

y

a

bl

ea

t

m

atur

i

t

y

I

n

te

r

est

p

a

y

ment

s

$$$$$

W

i

th

i

n one year

8

5

9

4

8

–

9

5

1 290

1

to 3

y

ears – – 5 318 475

3

to 5 years – – – 400 415

O

ver 5

y

ears – – –

3

,

200 2

,

2

7

9

8

5

9

4

8

54

,869 3,

45

9

(1) Includes accrued interest and dividends of

$

219

.

119