Shaw 2013 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

MANA

G

EMENT’

S

DI

SCUSS

I

O

N AND ANALY

S

I

S

August

31

,

2013

$

102 million

p

rimaril

y

due to hi

g

her o

p

eratin

g

income before amortization of $100 million. I

n

t

he fourth quarter of 2012, net income decreased

$

115 million, primarily due to lower

o

perating income before amortization of

$

66 million and increased income tax expense of

$

31

m

illion. The fourth

q

uarter also included a loss of $26 million in res

p

ect of the electrical fire a

t

t

he Company’s head office offset by a pension recovery of

$

25 million related to past servic

e

ad

j

ustments. In the third

q

uarter of 2012, net income increased

$

70 million mainl

y

due t

o

h

i

g

her o

p

eratin

g

income before amortization of $74 million

p

artiall

y

offset b

y

increased incom

e

t

ax expense of

$

17 million. In the second quarter of 2012, net income decreased

$

24 millio

n

d

ue to a decline in operating income before amortization of

$

73 million partially offset by lower

income tax ex

p

ense of $53 million. As a result of the aforementioned chan

g

es in net income

,

basic and diluted earnings per share have trended accordingly

.

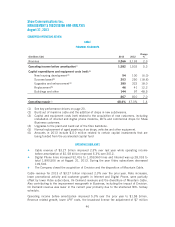

The

f

ollow

i

ng

f

urther ass

i

sts

i

n expla

i

n

i

ng the trend o

f

quarterly revenue and operat

i

ng

i

ncome

before amortization

:

G

r

o

w

t

h

i

n

subsc

r

ibe

r

statistics

(1)(2)

as fo

ll

o

w

s:

2013

2012

Subsc

r

ibe

r

Statistics

F

i

r

st Seco

n

d

Th

i

r

d

F

ou

r

t

hF

i

r

st Seco

n

d

Th

i

r

d

F

ou

r

th

V

i

deo customer

s

(23

,

8

77

) (29

,5

2

5

) (26

,57

8) (29

,5

22)

(22,886) (9,6

5

6) (21,2

77

) (16,119)

I

n

te

rn

et custo

m

e

r

s

5

,

63

77,

6

75 4,

1

57

10

,5

6

4

8

,74

820

,

812 2

,

230 6

,45

8

D

igital Phone lines

1

6

,

750 13

,

225 17

,

719 4

,

72

2

16

,

489 51

,

125 38

,

597 28

,

570

D

TH customer

s

(

4,

021) 1

,

328 (2

,

930) (83

5

)

531 1

,

2

74

(1

,

820) 1

,

1

55

(1) S

ubscr

i

ber numbers

f

or the com

p

arat

i

ve

p

er

i

od have been restated to remove

p

end

i

n

g

i

nstalls and have also been ad

j

usted to re

f

lect the results o

f

a pre-m

i

grat

i

on subscr

i

ber

audit recently undertaken prior to the planned migration of customers to Shaw’s ne

w

bi

ll

i

n

g

s

y

stem. The aud

i

tad

j

ustments relate

p

r

i

mar

i

l

y

to

p

er

i

ods

p

r

i

or to

2009

and re

f

lec

t

a reduct

i

on o

f

approx

i

mately

28

,

600

and

1

,

800

V

i

deo and Internet customers

,

respectively and an increase of 900 Digital phone lines. Also, given the growth in Digita

l

c

able

p

enetrat

i

on, the

C

om

p

an

y

now comb

i

ned the re

p

ort

i

n

g

o

f

Bas

i

c cable and D

igi

tal

cab

l

easa

V

ideo custo

m

e

r

.

(2) Subscriber numbers have been restated for comparative purposes to remove approximately

41

,

000

V

i

deo customers,

3

4,

000

Internet customers and

38

,

000

D

igi

tal

p

hone l

i

nes as

a

r

esu

l

to

f

t

h

esa

l

eo

fM

ou

n

ta

in

Cab

l

e

.

4

0