Shaw 2013 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

MANA

G

EMENT’

S

DI

SCUSS

I

O

N AND ANALY

S

I

S

August

31

,

2013

SU

B

SC

RIBER

S

TATI

S

TI

CS

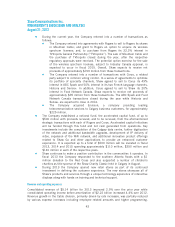

2

013 201

2

(1)(2)

Growth

C

han

g

e

%

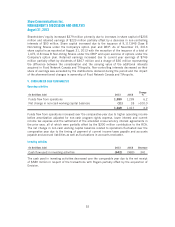

VIDEO

:

Co

nn

ected

2,040,24

7

2

,149,749 (109,502) (5.1)

Penetrat

i

on as a

%

o

f

homes

p

asse

d

5

0

.

9%

55.

0%

INTERNET

:

Co

nn

ected

1

,

890

,5

06

1

,

862

,47

328

,

033 1

.5

Penetration as % of video 92.7%

8

6.6%

Sta

n

d

-

a

l

o

n

e

In

te

rn

et

n

ot

in

c

l

uded

in vi

deo

320,724 252,437 68,287 27.

1

DIGITAL PHONE:

N

u

m

be

r

of

l

i

n

es

(3)

1

,

3

5

9

,

960

1

,

30

7,544 5

2

,4

16

4.

0

(1) Internet and Digital Phone subscriber statistics have been restated to exclude schedule

d

and

p

end

i

n

gi

nstallat

i

ons at Au

g

ust

31

,

2012

and all cate

g

or

i

es have been ad

j

usted t

o

re

f

lect the results o

f

a pre-m

i

grat

i

on subscr

i

ber aud

i

t undertaken pr

i

or to the m

i

grat

i

on o

f

c

ustomers to Shaw’s new billing system

.

(2) S

ubscr

i

ber numbers have been restated

f

or com

p

arat

i

ve

p

ur

p

oses to remove a

pp

rox

i

matel

y

41

,

000

V

i

deo customers,

3

4,

000

Internet customers and

38

,

000

D

i

g

i

tal phone l

i

nes as

a

result of the sale of Mountain Cable.

(3)

Re

p

resents

p

r

i

mar

y

and secondar

y

l

i

nes on b

i

ll

i

n

g

.

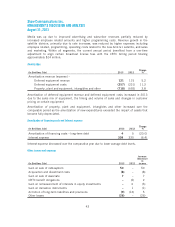

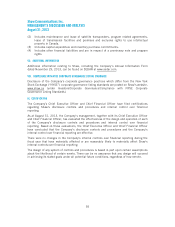

SATELLITE

FINANCIAL HIGHLIGHT

S

(

1)

($

millions Cdn) 2013 201

2

C

hange

%

R

e

v

e

n

ue

860

8

44 1.

9

Op

erat

i

n

gi

ncome be

f

ore amort

i

zat

i

on

(2)

285

293 (2

.7

)

Capital expenditures and equipment costs (net)

:

Success

-

based

(3

)

88

81 8

.

6

T

rans

p

on

d

er

s

23

2

>

100

.

0

Bu

i

ld

i

ngs and othe

r

12

11 9

.

1

123

9

4 30.9

Operating margin

(2)

3

3.1% 34.7% (1.6)

(1)

The

S

atell

i

te se

g

ment was

p

rev

i

ousl

y

re

p

orted as DTH and

S

atell

i

te

S

erv

i

ces. These

segments have been comb

i

ned

i

nto a s

i

ngle operat

i

ng segment.

(2) See key performance drivers on page 20

.

(3)

Net o

f

the

p

ro

fi

t on the sale o

f

satell

i

te e

q

u

ip

ment as

i

t

i

sv

i

ewed as a recover

y

o

f

e

xpend

i

tures on customer prem

i

se equ

i

pment

.

4

8