Shaw 2013 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

N

O

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

August 31, 2013 and 201

2

[all amounts in millions of Canadian dollars exce

p

t share and

p

er share amounts

]

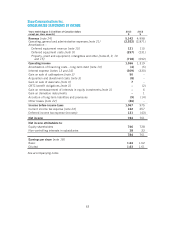

The Company’s interest in the assets, liabilities, results of operations and cash flows of these

j

oint ventures are as follows:

2013

$

2012

$

C

urrent asset

s

10

8

Pro

p

ert

y

,

p

lant and e

q

u

ip

men

t

15

16

25

24

C

urrent liabilitie

s

2

1

L

on

g

-term

d

e

b

t

19

20

Pro

p

ortionate share of net asset

s

4

3

2013

$

2012

$

Re

v

e

n

ue

27

31

O

perating, general and administrative expenses

(

11)

(

14)

A

m

o

r

ti

z

ation

(1)

(1)

I

nteres

t

(

1

)

(

1

)

O

ther ga

i

n

s

1

1

Pro

p

ort

i

onate share o

fi

ncome be

f

ore

i

ncome taxe

s

15

16

C

ash

f

low

p

rov

i

ded b

y

o

p

erat

i

n

g

act

i

v

i

t

i

es

15

14

C

ash flow used in financing activities

(

1

)

(1)

Proportionate share of cash distributions 1

4

13

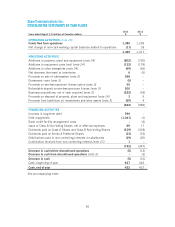

N

on-controll

i

n

gi

nterests ar

i

se

f

rom bus

i

ness comb

i

nat

i

ons

i

nwh

i

ch the

C

om

p

an

y

ac

q

u

i

res les

s

t

han 100% interest. At the time of acquisition, non-controlling interests are measured at either

f

air value or their

p

ro

p

ortionate share of the fair value of ac

q

uiree’s identifiable assets. The

C

om

p

an

y

determ

i

nes the measurement bas

i

s on a transact

i

on b

y

transact

i

on bas

i

s.

S

ubse

q

uen

t

t

o acquisition, the carrying amount of non-controlling interests is increased or decreased fo

r

t

heir share of chan

g

es in e

q

uit

y.

Investments and other assets

I

nvestments in associates are accounted for using the equity method based on the Company’s

abilit

y

to exercise si

g

nificant influence over the o

p

eratin

g

and financial

p

olicies of the investee.

I

nvestments o

f

th

i

s nature are recorded at or

igi

nal cost and ad

j

usted

p

er

i

od

i

call

y

to reco

g

n

i

z

e

t

he Company’s proportionate share of the associate’s net income or losses after the date o

f

investment

,

additional contributions made and dividends received

.

I

nvestments where the Com

p

an

y

doesn’t exercise si

g

nificant influence are accounted for at fair

value unless

i

nvestments don’t have

q

uoted market

p

r

i

ces

i

n an act

i

ve market and the

i

r

f

a

ir

value cannot be reliably measured. Investments are written down when there has been

a

si

g

nificant or

p

rolon

g

ed decline in fair value

.

68