Shaw 2013 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.S

haw

C

ommunications Inc

.

MANA

G

EMENT’

S

DI

SCUSS

I

O

N AND ANALY

S

I

S

August

31

,

2013

t

he

C

om

p

an

y

. In add

i

t

i

on to com

p

ensat

i

on

p

rov

i

ded to ke

y

mana

g

ement

p

ersonnel and the

B

oard of Directors for services rendered, the Company transacts with companies related t

o

certain Board members primarily for the purchase of remote control units and agency services

f

or d

i

rect sales and related

i

nstallat

i

on o

f

e

q

u

ip

ment

.

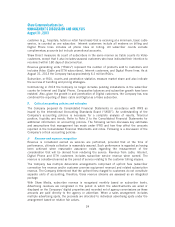

H. New accountin

g

standard

s

S

haw has ado

p

ted or w

i

ll ado

p

t a number o

f

new account

i

n

gp

ol

i

c

i

es as a result o

f

recen

t

changes

i

n IFR

S

as

i

ssued by the IA

S

B. The ensu

i

ng d

i

scuss

i

on prov

i

des add

i

t

i

onal

i

n

f

ormat

i

o

n

as to the date that Shaw is or was required to adopt the new standards, the methods o

f

ado

p

t

i

on

p

erm

i

tted b

y

the standards, the method chosen b

yS

haw, and the e

ff

ect on the

fi

nanc

i

al statements as a result o

f

adopt

i

ng the new pol

i

cy. The adopt

i

on or

f

uture adopt

i

on o

f

t

hese accounting policies has not and is not expected to result in changes to the Company’s

current bus

i

ness

p

ract

i

ces

.

Adoption o

f

recent accounting pronouncement

s

The Company adopted the following standards and amendments effective September 1, 2012

:

(i)

Em

p

lo

y

ee Bene

fi

t

s

IAS 19

,

Employee Benefit

s

(amended 2011), eliminates the existing option to defer

actuar

i

al

g

a

i

ns and losses and re

q

u

i

res chan

g

es

f

rom the remeasurement o

f

de

fi

ned

b

ene

fi

t plan assets and l

i

ab

i

l

i

t

i

es to be presented

i

n the statement o

f

othe

r

c

omprehensive income. The significant amendments to IAS 19 which impact the

C

om

p

an

y

are as

f

ollows:

Š

Expected return on plan assets is replaced with interest income and calculated

b

ased on the d

i

scount rate used to measure the

p

ens

i

on obl

ig

at

i

on; the d

iff

erenc

e

b

etween

i

nterest

i

ncome and actual return on plan assets

i

s recogn

i

zed

i

n other

c

omprehensive incom

e

Š

Immed

i

ate reco

g

n

i

t

i

on o

fp

ast serv

i

ce costs when

p

lan amendments occu

r

regardless o

f

whether or not they are veste

d

Š

P

lan administration costs, other than costs associated with managing plan assets

,

are re

q

u

i

red to be ex

p

ense

d

Š

Expanded d

i

sclosures

i

nclud

i

ng plan character

i

st

i

cs and r

i

sks ar

i

s

i

ng

f

rom de

fi

ne

d

b

enefit plan

s

The

C

om

p

an

y

earl

y

ado

p

ted the amended standard w

i

th retros

p

ect

i

ve restatement

e

ffective September 1, 2012 and the impact of adoption is outlined in Note 2 of th

e

c

onsolidated financial statements.

(

ii) Presentation of Financial Statement

s

IA

S1,

P

resentat

i

on o

f

F

i

nanc

i

al

S

tatement

s

,

was amended to re

q

u

i

re

p

resentat

i

on o

f

i

tems o

f

other comprehens

i

ve

i

ncome based on whether they may be reclass

ifi

ed to the

statement of income and has been applied retrospectively.

(iii)

Income Taxe

s

IAS 12

,

Income Taxe

s

(

amended 2011), introduces an exce

p

tion to the

g

eneral

m

easurement re

q

u

i

rements o

f

IA

S12i

n res

p

ect o

fi

nvestment

p

ro

p

ert

i

es measured at

f

a

i

r

value. The amendment had no impact on the Company’s consolidated financia

l

s

t

a

t

emen

t

s

.

31