Shaw 2013 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.S

haw

C

ommunications Inc

.

MANA

G

EMENT’

S

DI

SCUSS

I

O

N AND ANALY

S

I

S

August

31

,

2013

O

PERATIN

G

HI

G

HLI

G

HT

S

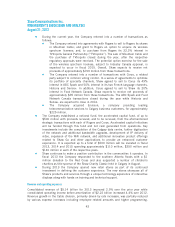

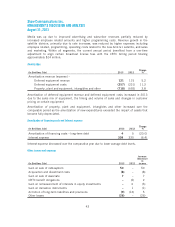

Current

y

ear revenue of $1.11 billion and o

p

eratin

g

income before amortization of $353 millio

n

compared to

$

1.05 billion and

$

332 million, respectively, for the prior year. Improve

d

advertisin

g

and subscriber revenues were

p

artiall

y

reduced b

y

hi

g

her

p

ro

g

rammin

g

costs, and

i

ncreased ex

p

enses

i

nclud

i

n

g

em

p

lo

y

ee related amounts due to

g

rowth and mer

i

t

i

ncreases, and

various other. The current year also benefited from an expense adjustment of

$

3 million to alig

n

certain broadcast license fees with the CRTC billing period.

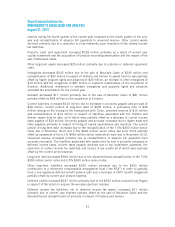

Global delivered solid programming results throughout the year with key shows such as Survivor

,

NC

I

S

, Bones and Hawa

ii

5-

0

. The convent

i

onal

f

all

p

ro

g

ramm

i

n

gp

rem

i

ered throu

g

h the mont

h

o

f September and into early October, with a solid returning line-up combined with new dram

a

programming that includes The Blacklist, Sleepy Hollow and Dracula. Shaw Media also adde

d

several new comed

i

es to the

f

all schedule

i

nclud

i

n

g

The M

i

llers,

S

ean

S

aves the World, and The

Mic

h

ae

l

J

F

o

x

S

h

o

w

.

I

n early

S

eptember

G

lobal

G

o launched prov

i

d

i

ng

2

4

/

7 stream

i

ng o

fG

lobal content plus

f

ull

i

n-

season stacking for key properties, making Shaw Media the first conventional broadcaster in

C

anada to o

ff

er

i

n-season stack

i

n

g.

Throu

g

hout the

y

ear, Med

i

a’s s

p

ec

i

alt

yp

ort

f

ol

i

o cons

i

stentl

y

lead

i

n the channel rank

i

n

g

s

i

n the

Adult

2

5-54 category and closed out the year w

i

th 4 o

f

the Top

10

analog channels, and

6

o

f

t

he Top 10 digital channels. National Geographic Canada, Action, Lifetime and MovieTime held

t

he to

p

4d

igi

tal

p

os

i

t

i

ons. DT

O

UR, a new l

if

est

y

le channel, launched

i

n late Au

g

ust add

i

n

g

t

o

S

haw Med

i

a’s port

f

ol

i

oo

f

spec

i

alty channels

.

G

lobal News cont

i

nues to ma

i

nta

i

n the number one pos

i

t

i

on

i

n the Vancouver,

C

algary an

d

E

dmonton markets and was the go to source for coverage of the Southern Alberta floods tha

t

o

ccurred

i

n late June. In add

i

t

i

on

,G

lobal launched a B

C

All News

C

hannel

,G

lobal News: B

C1,

as well as Morn

i

ng News programs

i

n Hal

if

ax and Montreal and a nat

i

onal hal

f

hour morn

i

ng

show in the current year. During 2013, Global News was the winner of the prestigious Edwar

d

R

. Murrow Award

f

or overall News excellence

i

n network telev

i

s

i

on

,

the

fi

rst

C

anad

i

an network

t

o earn that recogn

i

t

i

on

i

n the awards 4

2

year h

i

story

.

The Med

i

a bus

i

ness was recogn

i

zed dur

i

ng

2013

by the

C

anad

i

an

C

able

S

ystems All

i

ance a

s

B

roadcast Supplier of the Year for its ongoing partnership and support of the independent

s

y

stems

i

n

C

anada.

C

a

pi

tal

i

nvestment cont

i

nued on var

i

ous

p

ro

j

ects

i

n the current

y

ear and

i

ncluded u

pg

rad

i

n

g

production equipment, infrastructure and facility investments

.

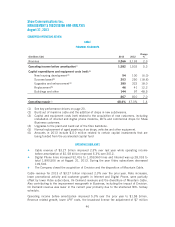

IV. FINAN

C

IAL P

OS

ITI

ON

Total assets were $12.7 billion at Au

g

ust 31, 2013 and Au

g

ust 31, 2012. Followin

g

is

a

d

iscussion of significant changes in the consolidated statement of financial position since

August 31, 2012

.

Current assets increased

$

144 million primarily due to the reclassification of assets held for

sale of $116 million and increase in accounts receivable of $53 million

p

artiall

y

offset b

ya

d

ecrease in other current assets of

$

17 million. Assets held for sale include the assets o

f

H

istoria and Series+ totaling

$

105 million, the majority of which is comprised of intangible

s

and $11 million in res

p

ect of a

p

ro

p

ert

y

which will be sold. Accounts receivable increased du

e

t

o the combination of rate increases, timing of collection of trade receivables, higher advertising

50