Shaw 2013 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

N

O

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

August 31, 2013 and 201

2

[all amounts in millions of Canadian dollars exce

p

t share and

p

er share amounts

]

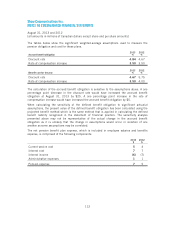

(iii) Non-cash transaction

s

The Consolidated Statements of Cash Flows exclude the following non-cash transactions

:

2

013 2012

$$

Issuance o

fC

lass B Non-Vot

i

ng

S

hares

:

Dividend reinvestment

p

lan

[

note 19]

1

26 98

Issuance o

fp

rom

i

ssor

y

note

:

T

ransactions with a related party

[

notes 3 and 27]

4

8

–

30

.

C

APITAL

S

TR

UC

T

U

RE MANA

G

EMENT

The

C

om

p

an

y

’s ob

j

ect

i

ves when mana

gi

n

g

ca

pi

tal are:

(i)

to ma

i

nta

i

naca

pi

tal structure wh

i

ch o

p

t

i

m

i

zes the cost o

f

ca

pi

tal,

p

rov

i

des

f

lex

i

b

i

l

i

t

y

an

d

di

vers

i

ty o

ff

und

i

ng sources and t

i

m

i

ng o

f

debt matur

i

t

i

es, and adequate ant

i

c

i

pated

l

iquidity for organic growth and strategic acquisitions

;

(ii) to maintain compliance with debt covenants; and

(iii) to manage a strong and efficient capital base to maintain investor, creditor and market

co

n

fide

n

ce

.

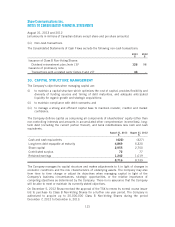

The Company defines capital as comprising all components of shareholders’ equity (other than

n

on-controll

i

n

gi

nterests and amounts

i

n accumulated other com

p

rehens

i

ve

i

ncome

/

loss

)

, lon

g

-

t

erm debt

(i

nclud

i

ng the current port

i

on thereo

f)

, and bank

i

ndebtedness less cash and cash

equivalents

.

A

u

g

ust

31

,

2013

$

A

u

g

ust

31

,

2012

$

C

ash and cash e

q

u

i

valent

s

(

4

22)

(

4

2

7

)

Long-term debt repayable at maturity

4,

869 5,32

0

S

hare ca

pi

tal

2

,

9

5

5

2

,75

0

C

ontributed surplus 72

7

7

Reta

i

ned earn

i

ng

s

1

,

2

4

2

1

,

019

8

,7

16

8,

7

39

The Company manages its capital structure and makes adjustments to it in light of changes in

economic conditions and the risk characteristics of underl

y

in

g

assets. The Com

p

an

y

ma

y

als

o

f

rom t

i

me to t

i

me chan

g

eorad

j

ust

i

ts ob

j

ect

i

ves when mana

gi

n

g

ca

pi

tal

i

nl

ig

ht o

f

the

Company’s business circumstances, strategic opportunities, or the relative importance of

com

p

etin

g

ob

j

ectives as determined b

y

the Com

p

an

y

. There is no assurance that the Com

p

an

y

w

i

ll be able to meet or ma

i

nta

i

n

i

ts currentl

y

stated ob

j

ect

i

ves

.

O

n December 5,

2012 S

haw rece

i

ved the a

pp

roval o

f

the T

S

X to renew

i

ts normal course

i

ssuer

bid to purchase its Class B Non-Voting Shares for a further one year period. The Company is

authorized to ac

q

uire u

p

to 20,000,000 Class B Non-Votin

g

Shares durin

g

the

p

eriod

D

ecember 7,

2012

to December

6

,

2013

.

121