Shaw 2013 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

N

O

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

August 31, 2013 and 201

2

[all amounts in millions of Canadian dollars exce

p

t share and

p

er share amounts

]

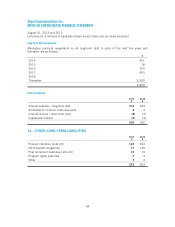

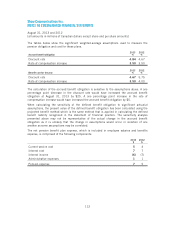

Significant changes recognized to deferred income tax assets (liabilities) are as follows

:

Property, plan

t

a

nd equipmen

t

a

n

d soft

w

a

r

e

assets

$

B

roadcast

r

ights,

licenses

,

t

ra

d

emar

k

a

n

d

b

r

a

n

ds

$

P

artnersh

ip

i

n

co

m

e

$

Non-capital

l

oss carr

y

-

fo

rw

a

r

ds

$

Acc

r

ued

c

h

ar

g

e

s

$

F

oreig

n

e

xchange o

n

long-term debt

and fair value

of de

r

i

v

ati

v

e

i

n

st

r

u

m

e

n

ts

$

Tota

l

$

B

a

l

a

n

ce at

Se

p

tember 1, 2011 (145) (820) (354) 50 132 3 (1,134

)

Recogn

i

zed

i

n statemen

t

o

fi

ncome

12 (18) 83 (1

7

)(1

7

)

–4

3

Reco

g

nized in othe

r

com

p

rehens

i

ve loss – – – –

22

–

22

Recogn

i

zed on bus

i

ness

ac

q

uisition – (2) – – – – (2

)

Balance at Au

g

ust 31,

2012 (133) (840) (271) 33 137 3 (1

,

071

)

Recogn

i

zed

i

n statemen

t

o

fi

ncome

(18) (1

4

)

4

(2

7

) (63) (3) (121)

Reco

g

nized in othe

r

com

p

rehensive income – – – – (1) (1) (2

)

Recogn

i

zed on bus

i

ness

d

i

spos

i

t

i

on and other

11

4

1

–––– 5

2

Balance at August

31

,

2013 (1

4

0) (813) (26

7

)6

7

3 (1) (1

,

1

4

2)

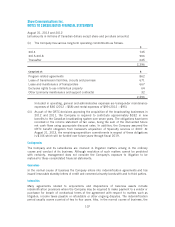

The Com

p

an

y

has ca

p

ital loss carr

y

forwards of a

pp

roximatel

y$

61 for which no deferred incom

e

t

ax asset has been reco

g

n

i

zed

i

n the accounts. These ca

pi

tal losses can be carr

i

ed

f

orward

indefinitely

.

The Company has taxable temporary differences associated with its investment in its

subsidiaries. No deferred tax liabilities have been

p

rovided with res

p

ect to such tem

p

orar

y

diff

erences as the

C

om

p

an

yi

s able to control the t

i

m

i

n

g

o

f

the reversal and such reversal

i

sno

t

probable in the foreseeable future

.

103