Shaw 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.S

haw

C

ommunications Inc

.

MANA

G

EMENT’

S

DI

SCUSS

I

O

N AND ANALY

S

I

S

August

31

,

2013

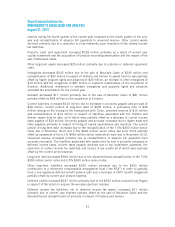

revenue dur

i

n

g

the

f

ourth

q

uarter o

f

the current

y

ear com

p

ared to the

f

ourth

q

uarter o

f

the

p

r

i

o

r

year and reclassification of advance bill payments to unearned revenue. Other current assets

d

eclined primarily due to a reduction in a tax indemnity upon resolution of the related income

ta

xl

iabi

l

ities

.

P

ro

p

ert

y

,

p

lant and e

q

ui

p

ment increased $128 million

p

rimaril

y

as a result of current

y

ea

r

capital investment and the acquisition of Envision exceeding amortization and the impact of the

sale of Mountain Cable

.

Other long-term assets decreased

$

25 million primarily due to a decline in deferred equipmen

t

costs

.

I

ntan

g

ibles decreased $202 million due to the sale of Mountain Cable of $245 million an

d

reclassification of

$

92 million in respect of Historia and Series+ to assets held for sale partiall

y

o

ffset by higher program rights and advances of

$

33 million, an increase in other intangibles o

f

$

19 million and the reco

g

nition of $87 million in customer relationshi

p

s on the ac

q

uisition o

f

E

nv

i

s

i

on. Add

i

t

i

onal

i

nvestment

i

nso

f

tware

i

ntang

i

bles and acqu

i

red r

i

ghts and advance

s

exceeded the amortization for the current year

.

Goodwill decreased

$

17 million primarily due to the sale of Mountain Cable of

$

81 million

p

artiall

y

offset b

y

$68 million on the ac

q

uisition of Envision.

Current liabilities increased $610 million due to increases in accounts

p

a

y

able and accruals o

f

$

48 million, current portion of long-term debt of

$

499 million, a promissory note of

$

48

m

illion arising on the closing of the transactions with Corus, unearned revenue of

$

15 millio

n

and reclassification of $14 million in res

p

ect of liabilities associated with the Historia an

d

S

er

i

es+ assets held

f

or sale, all o

f

wh

i

ch were part

i

ally o

ff

set by a decrease

i

n current

i

ncom

e

t

axes payable of

$

20 million. Accounts payable and accruals increased due to higher trade an

d

o

ther

p

a

y

ables

p

r

i

mar

i

l

yi

n res

p

ect o

f

t

i

m

i

n

g

o

f

ca

pi

tal ex

p

end

i

tures and

i

nventor

y

. The curren

t

portion of long-term debt increased due to the reclassification of the 7.5%

$

350 million senior

n

otes due in November 2013 and 6.5%

$

600 million senior notes due June 2014 partiall

y

o

ffset b

y

re

p

a

y

ment of the 6.1% $450 million senior notes which were due in November 2012

.

U

nearned revenue

i

ncreased pr

i

mar

i

ly due to reclass

ifi

cat

i

on o

f

advance b

i

ll payments

f

rom

accounts receivable. The liabilities associated with assets held for sale is primarily composed of

d

e

f

erred

i

ncome taxes. Income taxes

p

a

y

able decl

i

ned due to tax

i

nstallment

p

a

y

ments, th

e

resolution of certain income tax liabilities and receipt of tax credits all of which were partially

o

ffset by the current period expense.

L

ong-term debt decreased

$

944 million due to the aforementioned reclassification of the 7.5

%

$

350 million senior notes and 6.5% $600 million senior notes.

Other lon

g

-term liabilities decreased $330 million

p

rimaril

y

due to the $300 million

contribution to a retirement compensation arrangement trust (“the RCA”) in order to partially

f

und a non-registered defined benefit pension plan and a decrease in CRTC benefit obligations

p

art

i

all

y

o

ff

set b

y

current

y

ear

p

ens

i

on ex

p

ense

.

D

eferred credits increased $237 million

p

rimaril

y

due to the $250 million received from Ro

g

ers

in respect of the option to acquire the wireless spectrum licenses.

D

eferred income tax liabilities, net of deferred income tax assets, increased

$

71 millio

n

primarily due to current year expense partially offset by the sale of Mountain Cable and th

e

a

f

orement

i

oned reclass

ifi

cat

i

on o

f

amounts

i

n res

p

ect o

f

H

i

stor

i

a and

S

er

i

es+.

51