Shaw 2013 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

MANA

G

EMENT’

S

DI

SCUSS

I

O

N AND ANALY

S

I

S

August

31

,

2013

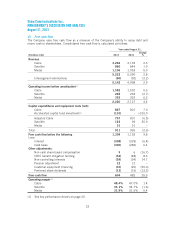

F

ree cash

f

low

i

s calculated as o

p

erat

i

n

gi

ncome be

f

ore amort

i

zat

i

on, less

i

nterest, cash taxes

paid or payable, capital expenditures (on an accrual basis and net of proceeds on capita

l

d

ispositions and adjusted to exclude amounts funded through the accelerated capital fund) an

d

e

q

u

ip

ment costs

(

net

)

,ad

j

usted to exclude share-based com

p

ensat

i

on ex

p

ense, less cash

amounts associated with funding the new and assumed CRTC benefit obligations related to the

ac

q

uisition of Shaw Media as well as excludin

g

non-controllin

g

interest amounts that are

consol

i

dated

i

n the o

p

erat

i

n

gi

ncome be

f

ore amort

i

zat

i

on, ca

pi

tal ex

p

end

i

ture and cash tax

amounts. Free cash flow also includes changes in receivable related balances with respect t

o

customer equipment financing transactions as a cash item, and is adjusted for recurring cash

f

und

i

n

g

o

fp

ens

i

on amounts net o

fp

ens

i

on ex

p

ense. D

i

v

i

dends

p

a

i

d on the

C

om

p

an

y

’s

Cu

m

u

l

at

iv

e

R

edee

m

ab

l

e

R

ate

R

eset

Pr

e

f

e

rr

ed S

h

a

r

es a

r

ea

l

so deducted.

F

ree cash flow has not been reported on a segmented basis. Certain components of free cash

f

low includin

g

o

p

eratin

g

income before amortization, ca

p

ital ex

p

enditures (on an accrual basi

s

n

et o

fp

roceeds on ca

pi

tal d

i

s

p

os

i

t

i

ons

)

and e

q

u

ip

ment costs

(

net

)

,

C

RT

C

bene

fi

t obl

ig

at

i

on

f

unding, and non-controlling interest amounts continue to be reported on a segmented basis.

Other items, includin

g

interest and cash taxes, are not

g

enerall

y

directl

y

attributable to

a

se

g

ment, and are re

p

orted on a consol

i

dated bas

i

s

.

F

or free cash flow

p

ur

p

oses the Com

p

an

y

considers the initial $300 million su

pp

lementa

l

execut

i

ve ret

i

rement plan

f

und

i

ng to be a

fi

nanc

i

ng transact

i

on and has not

i

ncluded the

amount funded or the related cash tax recovery in the free cash flow calculation

.

i

v

)

Accelerated cap

i

tal

f

un

d

The Company established a notional fund, the accelerated capital fund, of up to $500 million

with proceeds received, and to be received, from several strategic transactions with each o

f

R

o

g

ers and

C

orus. The accelerated ca

pi

tal

i

n

i

t

i

at

i

ves w

i

ll be

f

unded throu

g

hth

i

s

f

und and no

t

cash generated

f

rom operat

i

ons. Key

i

nvestments

i

nclude the complet

i

on o

f

the

C

algary dat

a

centre, further digitization of the network and additional bandwidth upgrades, development of

I

P del

i

ver

y

o

f

v

i

deo, ex

p

ans

i

on o

f

the W

i

F

i

network, and add

i

t

i

onal

i

nnovat

i

ve

p

roduct o

ff

er

i

n

gs

related to

S

haw

G

o and other appl

i

cat

i

ons to prov

i

de an enhanced customer exper

i

ence. It

is

expected up to a total of

$

500 million will be invested in fiscal 2013, 2014 and 2015

,

s

p

endin

g

a

pp

roximatel

y

$110 million, $250 million and $140 million in each of the res

p

ective

years.

D

eta

i

ls on the accelerated cap

i

tal

f

und and

i

nvestment dur

i

ng

2013

are as

f

ollows:

E

stimated year of spend 2013 2014 2015 Tota

l

(

$millions Cdn

)

F

und

Op

en

i

n

g

Balance

110 2

5

01

4

0

5

00

A

ccelerated ca

p

ital investment

1

10 – – 110

F

und Closing Balance, August 31, 2013 – 250 140 390

S

TATI

S

TI

C

AL MEA

SU

RE

S:

S

ubscriber counts (or revenue generating units), including penetration and bundled customer

s

The

C

om

p

an

y

measures the count o

fi

ts customers

i

n

C

able and DTH

(S

haw D

i

rect

)

.V

i

deo cable

subscribers include residential customers, multiple dwelling units (“MDUs”) and commercia

l

customers. A residential subscriber who receives at a minimum

,

basic cable service

,

is counte

d

as one subscr

i

ber. In the case o

f

MDUs, such as a

p

artment bu

i

ld

i

n

g

s, each tenant w

i

th

a

m

inimum of basic cable service is counted as one subscriber, regardless of whether invoiced

individually or having services included in his or her rent. Each building site of a commercia

l

23