Shaw 2013 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

N

O

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

August 31, 2013 and 201

2

[all amounts in millions of Canadian dollars exce

p

t share and

p

er share amounts

]

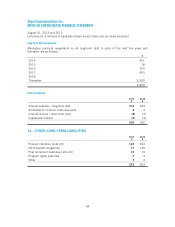

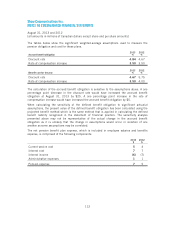

The income tax expense differs from the amount computed by applying Canadian statutory rate

s

t

o income before income taxes for the followin

g

reasons:

2013 2012

$

$

C

urrent statutor

yi

ncome tax rat

e

25

.

9%

26

.

3%

I

ncome tax ex

p

ense at current statutor

y

rate

s

2

7

6

256

Net increase (decrease) in taxes resulting from:

E

ff

ect o

f

tax rate chan

g

es

10

11

Recognition of previously unrecognized deferred tax asset

s

–

(

32)

Reco

g

n

i

t

i

on o

fp

rev

i

ousl

y

unreco

g

n

i

zed tax losses

(12)

–

O

riginating temporary differences recorded at future tax rates expected to

be i

n

effect

wh

e

nr

ea

l

i

z

ed

–

2

O

the

r

9

(

23)

Income tax expense

2

8

3

214

D

ue to

C

anad

i

an

f

ederal and

p

rov

i

nc

i

al enacted cor

p

orate

i

ncome tax rate chan

g

es, the

statutory

i

ncome tax rate

f

or the

C

ompany decreased

f

rom

26

.

3% i

n

2012

to

2

5.

9% i

n

2013

.

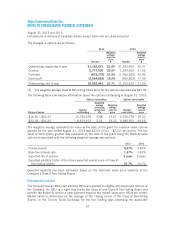

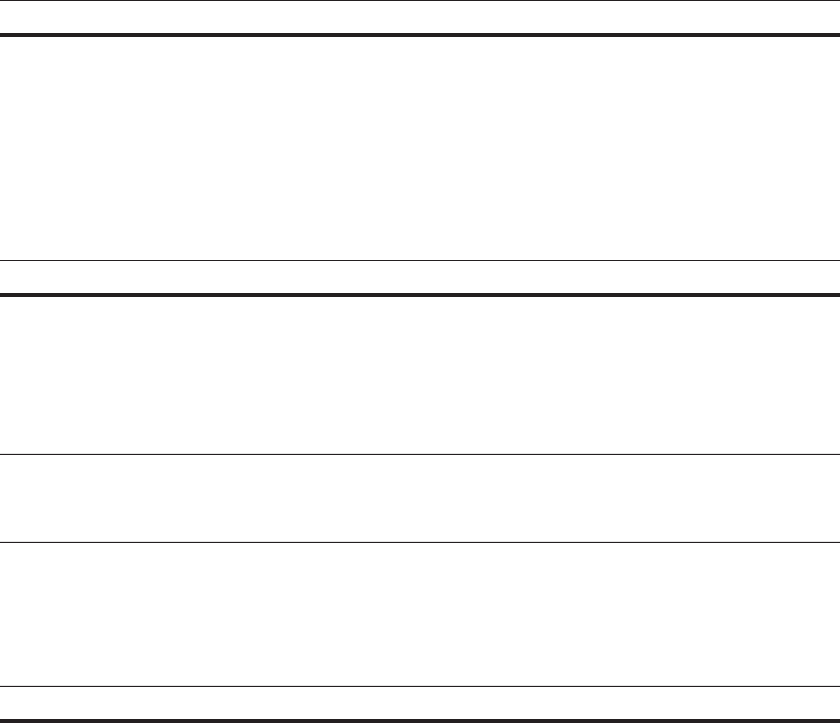

The components o

fi

ncome tax expense are as

f

ollows

:

2013 2012

$$

C

urrent

i

ncome tax expense

174

25

7

C

urrent

i

ncome tax recover

yf

rom reco

g

n

i

t

i

on o

fp

rev

i

ousl

y

unreco

g

n

i

zed tax

losses

(12)

–

162

25

7

Deferred tax ex

p

ense (recover

y

) related to tem

p

orar

y

differences 111

(

22

)

De

f

erred tax expense

f

rom tax rate changes

10

11

De

f

erred tax recover

yf

rom reco

g

n

i

t

i

on o

fp

rev

i

ousl

y

unreco

g

n

i

zed de

f

erred

ta

x

assets

–

(32)

I

ncome tax expense

283

214

10

4