Shaw 2013 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

MANA

G

EMENT’

S

DI

SCUSS

I

O

N AND ANALY

S

I

S

August

31

,

2013

III. RE

SU

LT

SO

F

O

PERATI

O

N

S

O

VERVIEW

O

FFI

SC

AL

2013 CO

N

SO

LIDATED RE

SU

LT

S

C

han

g

e

(

In

$

millions Cdn exce

p

t

p

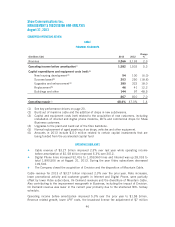

er share amounts) 2013 2012 201

1

2013

%

2012

%

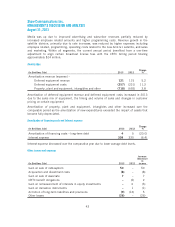

Operations

:

Revenu

e

5,

14

2

4

,

998 4

,

74

1

2

.

9

5

.4

O

p

eratin

g

income before amortizatio

n

(1

)

2,

22

0

2,

127 2

,

05

1

4

.

4

3

.7

Op

erat

i

n

g

mar

gin

(1

)

4

3

.

2%

4

2

.

6%

4

3

.

3%

0

.

6

(0

.7

)

Funds

f

low

f

rom o

p

erat

i

on

s

(2)

1

,

380

1,299 1,

4

33

6

.

2

(9

.4

)

N

et i

n

co

m

e

78

47

61 559

3

.

0

36

.

1

Fr

ee cas

h

f

l

ow

(1)

60

44

82 617

25

.

3

(21

.

9)

Bala

n

ce sheet

:

Tota

l

assets

12

,7

32

12

,7

22 12

,5

88

Long-term

fi

nanc

i

al l

i

ab

i

l

i

t

i

es

(i

nclud

i

ng curren

t

port

i

on

)

L

ong-term deb

t

4,818 5,263 5,25

7

D

erivative instrument

s

–

1

8

Other financial liabilities

53

4

16

8

Pe

r

sha

r

e data:

Earn

i

ngs per share

Bas

i

c

1

.

6

4

1

.

6

2 1.2

3

D

ilute

d

1

.6

3

1

.61 1.23

Weighted average number of participating

shares outstanding during period (millions

)

4

48 441 435

C

ash d

i

v

i

dends declared

p

er share

Class A 1.005

0

0

.9550 0.9075

Class B 1.0075

0

.9575 0.9100

(1) S

ee ke

yp

er

f

ormance dr

i

vers on

p

a

g

e

20.

(2)

Funds

f

low

f

rom operat

i

ons

i

s presented be

f

ore changes

i

n non-cash work

i

ng cap

i

tal a

s

presented in the Consolidated Statements of Cash Flows.

Hi

g

hli

g

hts

Š

Net income was

$

784 million for the year compared to

$

761 million in 2012

.

Š

Earnin

g

s

p

er share were $1.64 com

p

ared to $1.62 in 2012.

Š

R

evenue for the year improved 2.9% to

$

5.14 billion from

$

5.00 billion last year

.

Š

Operating income before amortization of

$

2.22 billion was up 4.4% over last year’

s

amount of $2.13 billion

.

Š

Consolidated free cash flow was

$

604 million compared to

$

482 million in 2012.

Š

D

uring 2013 the Company increased the dividend rate on Shaw’s Class A

P

art

i

c

ip

at

i

n

gS

hares and

C

lass B Non-Vot

i

n

g

Part

i

c

ip

at

i

n

gS

hares to an e

q

u

i

valen

t

d

ividend rate of

$

1.0175 and

$

1.02 respectively. Dividends paid in 2013 were

$

445 million

.

4

1