Shaw 2013 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

N

O

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

August 31, 2013 and 201

2

[all amounts in millions of Canadian dollars exce

p

t share and

p

er share amounts

]

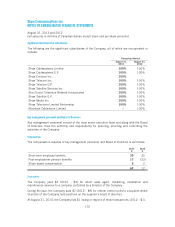

D

uring the current year, the Company established an executive retirement plan (“ERP”) fo

r

certain executives not covered b

y

the SERP. Benefits under this

p

lan are com

p

rised of define

d

contr

i

but

i

on and de

fi

ned bene

fi

t com

p

onents and are based on the em

p

lo

y

ees’ len

g

th o

f

serv

i

c

e

as well as final average earnings during their years of service. Employees are not required to

contribute to this

p

lan. Annuall

y

the em

p

lo

y

er is to fund 90% of the accrued benefit obli

g

ation

.

Subse

q

uent to

y

ear end, the Com

p

an

y

made contributions of $2 to an RCA

.

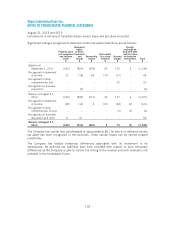

The table below shows the chan

g

e in benefit obli

g

ation and fundin

g

status and the fair value o

f

pl

an assets.

S

ER

P

$

ERP

$

2013

Total

$

2012

S

ER

P

$

A

ccrued bene

fi

t obl

ig

at

i

on, be

gi

nn

i

n

g

o

fy

ea

r

3

7

8

–

3

7

8

334

C

urrent service cost

8

210

7

P

ast se

rv

ice cost

4

–

4

–

Interest cost 17 – 17

19

G

a

i

n–

p

ast serv

i

ce ad

j

ustment

s

––

–

(2

5

)

Payment of benefits to employee

s

(9) – (9

)

(9

)

Re

m

easu

r

e

m

e

n

ts

:

E

ff

ect o

f

changes

i

n demograph

i

c assumpt

i

on

s

12

–

12

–

Effect of changes in financial assumptions (15) – (15

)

5

6

E

ff

ect o

f

ex

p

er

i

ence ad

j

ustment

s

9

–

9

(

4

)

A

ccrued bene

fi

t obl

ig

at

i

on, end o

fy

ea

r

40

4

2

4

06

3

7

8

Fa

i

r value o

fp

lan assets, be

gi

nn

i

n

g

o

fy

ea

r

––

–

–

Employer contributions

3

00 – 300

–

In

te

r

est i

n

co

m

e

13

–

13

–

Payment of benefit

s

(9) – (9

)

–

Return on

p

lan assets, exclud

i

n

gi

nterest

i

ncome

(2)

–

(2)

–

Fa

i

r value o

fp

lan assets, end o

fy

ea

r

302

–

302

–

A

ccrued bene

fi

tl

i

ab

i

l

i

t

y

and

p

lan de

fi

c

i

t, end o

fy

ear

102 2 104

3

7

8

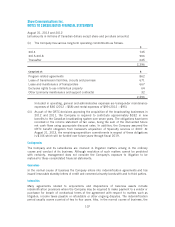

The weighted average duration of the defined benefit obligation of the SERP and ERP a

t

August 31, 2013 is 15.5 years and 23.4 years, respectively.

The underly

i

ng plan assets o

f

the

S

ERP at August

31

,

2013

are

i

nvested

i

n the

f

ollow

i

ng

:

$

C

ash and cash equ

i

valent

s

160

Fixed income securitie

s

8

0

E

q

u

i

t

y

secur

i

t

i

es –

C

anad

i

a

n

21

Equ

i

ty secur

i

t

i

es – Fore

i

g

n

41

302

All

fi

xed

i

ncome and e

q

u

i

t

y

secur

i

t

i

es have a

q

uoted

p

r

i

ce

i

n act

i

ve market

.

110