Shaw 2013 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.S

haw

C

ommunications Inc

.

N

O

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

August 31, 2013 and 201

2

[all amounts in millions of Canadian dollars exce

p

t share and

p

er share amounts

]

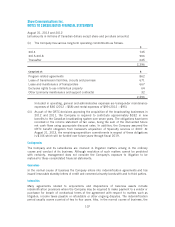

payment date as determined by the Company. When cash dividends are paid on Class B Non

-

V

otin

g

Shares, holders are credited with RSUs e

q

ual to the dividend. RSUs do not have votin

g

r

ig

hts as there are no shares underl

yi

n

g

the

p

lan

.

The RSUs

g

ranted durin

g

2011 vested durin

g

2013 and the Com

p

an

yp

aid $6 to settle th

e

o

bligation. During 2013,

$

3 was recorded as compensation expense (2012 –

$

2) and a

t

Au

g

ust 31, 2013, the carr

y

in

g

value of the liabilit

y

was $nil (2012 – $3)

.

Deferred share unit

p

lan

The Company has a DSU plan for its Board of Directors whereby directors can elect to receiv

e

t

heir annual cash com

p

ensation, or a

p

ortion thereof, in DSUs. In addition, the Com

p

an

y

ma

y

ad

j

ust and

/

or su

pp

lement d

i

rectors’ com

p

ensat

i

on w

i

th

p

er

i

od

i

c

g

rants o

f

D

S

Us. A D

S

U

i

s

a

right that tracks the value of one Class B Non-Voting Share. Holders will be entitled to a cas

h

p

a

y

out when the

y

cease to be a director. The cash

p

a

y

out will be based on market value of

a

C

lass B Non-Vot

i

n

gS

hare at the t

i

me o

fp

a

y

out. When cash d

i

v

i

dends are

p

a

i

don

C

lass B Non

-

V

oting Shares, holders are credited with DSUs equal to the dividend. DSUs do not have voting

ri

g

hts as there are no shares underl

y

in

g

the

p

lan

.

D

urin

g

2013,

$

4 was reco

g

nized as com

p

ensation ex

p

ense (2012 –

$

1). The carr

y

in

g

value an

d

intrinsic value of DSUs at Au

g

ust 31, 2013 was $10 and $8, res

p

ectivel

y

(Au

g

ust 31, 2012

–$

6 and

$

5, respectively).

E

mp

l

oyee s

h

are purc

h

ase p

l

an

The

C

om

p

an

y

’s E

S

PP

p

rov

i

des em

p

lo

y

ees w

i

th an

i

ncent

i

ve to

i

ncrease the

p

ro

fi

tab

i

l

i

t

y

o

f

the

Company and a means to participate in that increased profitability. Generally, all non-unionize

d

f

ull time or

p

art time em

p

lo

y

ees of the Com

p

an

y

are eli

g

ible to enroll in the ESPP. Under th

e

ES

PP, el

igi

ble em

p

lo

y

ees ma

y

contr

i

bute to a max

i

mum o

f

5

%

o

f

the

i

r monthl

y

base

compensation. The Company contributes an amount equal to 25% of the employee’

s

contributions.

D

urin

g

2013,

$

5 was recorded as com

p

ensation ex

p

ense (2012 –

$

5)

.

98