Shaw 2013 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

N

O

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

August 31, 2013 and 201

2

[all amounts in millions of Canadian dollars exce

p

t share and

p

er share amounts

]

20

.

O

THER

CO

MPREHEN

S

IVE IN

CO

ME

(

L

OSS)

AND A

CC

UMULATED

O

THE

R

COMPREHENSIVE LOS

S

C

omponents o

f

other comprehens

i

ve

i

ncome and the related

i

ncome tax e

ff

ects

f

or

2013

are as

f

ollows

:

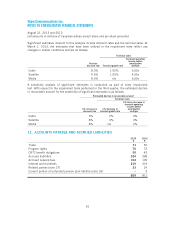

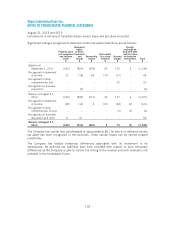

A

moun

t

$

I

n

c

ome taxes

$

N

e

t

$

I

tems that may subsequently be reclassified to incom

e

C

hange

i

n unreal

i

zed

f

a

i

r value o

f

der

i

vat

i

ves des

i

gnated as

c

ash flow hedge

s

5

(1)

4

A

d

j

ustment

f

or hed

g

ed

i

tems reco

g

n

i

zed

i

n the

p

er

i

od

(1)

–

(1)

4

(1) 3

I

tems that w

i

ll not be subse

q

uentl

y

reclass

ifi

ed to

i

ncom

e

Remeasurements on em

p

lo

y

ee benefit

p

lan

s

4

(

1

)

3

8

(2) 6

C

omponents o

f

other comprehens

i

ve loss and the related

i

ncome tax e

ff

ects

f

or

2012

are as

follows:

A

moun

t

$

I

n

c

ome taxes

$

N

e

t

$

I

tems that may subsequently be reclassified to incom

e

A

d

j

ustment

f

or hedged

i

tems recogn

i

zed

i

n the per

i

od

(3) 1 (2)

I

tems that will not be subsequently reclassified to incom

e

Remeasurements on em

p

lo

y

ee bene

fi

t

p

lans

(83) 21 (62)

(86) 22 (6

4

)

A

ccumulated other com

p

rehensive loss is com

p

rised of the followin

g:

2013

$

2012

$

I

tems that may subsequently be reclass

ifi

ed to

i

ncom

e

Fair value of derivative

s

2

(

1)

I

tems that will not be subsequently reclassified to incom

e

Remeasurements on employee benefit plan

s

(89)

(

92)

(87)

(

93)

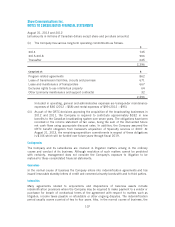

21

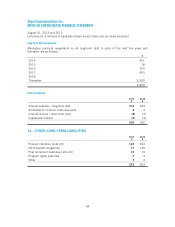

.

O

PERATIN

G

,

G

ENERAL AND ADMINI

S

TRATIVE EXPEN

S

E

S

2013

$

2012

$

Employee salar

i

es and bene

fi

ts

900

835

Purchases of

g

oods and service

s

2,

02

2

2,

036

2,

92

2

2,

871

101