Shaw 2013 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

N

O

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

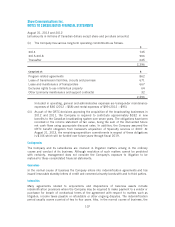

August 31, 2013 and 201

2

[all amounts in millions of Canadian dollars exce

p

t share and

p

er share amounts

]

22

.

O

THER L

OSS

E

S

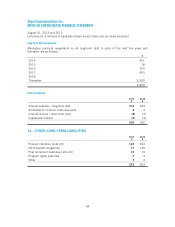

Other losses

g

enerall

y

includes realized and unrealized forei

g

n exchan

g

e

g

ains and losses on U

S

d

ollar denom

i

nated current assets and l

i

ab

i

l

i

t

i

es,

g

a

i

ns and losses on d

i

s

p

osal o

fp

ro

p

ert

y

,

p

lan

t

and equipment and minor investments, and the Company’s share of the operations of Burrar

d

L

anding Lot 2 Holdings Partnership. During the prior year, the category also included a pension

recover

y

of $25 which arose due to a

p

lan amendment to freeze salar

y

levels and a loss of $2

6

related to the electrical fire and resulting water damage at the Company’s head office i

n

Calgary, Alberta. The loss of

$

26 includes

$

6 of costs in respect of restoration and recovery

activities, includin

g

amounts incurred in the relocation of em

p

lo

y

ees, and a write-down of $2

0

related to the damages susta

i

ned to the bu

i

ld

i

ng and

i

ts contents. Insurance recover

i

es are

included in Other losses as claims are approved. During the current year, the Company received

insurance advances of $5 related to its claim for costs that were incurred in 2012 and incurred

additional costs of

$

13 in respect of ongoing recovery activities. In addition, during the curren

t

year, the Company decided to discontinue further construction on a real estate project which

resulted in a write-down of $14 and classification of $11 as assets held for sale at Au

g

ust 31

,

2013

.

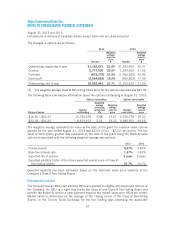

23. INCOME TAXE

S

D

e

f

erred

i

ncome taxes re

f

lect the net tax e

ff

ects o

f

temporary d

iff

erences between the carry

i

ng

amounts of assets and liabilities for financial reporting purposes and the amounts used for

i

ncome tax

p

ur

p

oses. The

C

om

p

an

y

’s net de

f

erred tax l

i

ab

i

l

i

t

y

cons

i

sts o

f

the

f

ollow

i

n

g

:

2

013

$

201

2

$

D

efe

rr

ed ta

x

assets

–

14

Deferred tax liabilitie

s

(1

,

142

)

(1,085

)

Net deferred tax liability (1

,

142

)

(1,071

)

102