Shaw 2013 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.S

haw

C

ommunications Inc

.

MANA

G

EMENT’

S

DI

SCUSS

I

O

N AND ANALY

S

I

S

August

31

,

2013

Š

D

ur

i

n

g

the current

y

ear, the

C

om

p

an

y

entered

i

nto a number o

f

transact

i

ons as

f

o

ll

o

w

s:

Š

T

he Company entered into agreements with Rogers to sell to Rogers its shares

i

n Mounta

i

n

C

able; and

g

rant to Ro

g

ers an o

p

t

i

on to ac

q

u

i

re

i

ts w

i

reles

s

s

pectrum licenses; and, to purchase from Rogers its 33.3% interest i

n

T

Vtro

p

olis General Partnershi

p

(“TVtro

p

olis”). The sale of Mountain Cable and

the

p

urchase o

f

TVtro

p

ol

i

s closed dur

i

n

g

the

y

ear, a

f

ter the res

p

ect

i

ve

regulatory approvals were received. The potential option exercise for the sale

of the wireless spectrum licenses, subject to Industry Canada approval, is

e

x

p

ected to occur

i

n

fi

scal

201

5.

O

verall,

S

haw ex

p

ects to rece

i

ve ne

t

proceeds of approximately

$

700 million from these transactions.

Š

T

he Company entered into a number of transactions with Corus, a related

p

art

y

sub

j

ect to common vot

i

n

g

control. In a ser

i

es o

f

a

g

reements to o

p

t

i

m

i

ze

i

ts port

f

ol

i

oo

f

spec

i

alty channels,

S

haw agreed to sell to

C

orus

i

ts 4

9%

i

nterest in ABC Spark and 50% interest in its two French-language channels,

H

i

stor

i

a and

S

er

i

es+. In add

i

t

i

on,

C

orus a

g

reed to sell to

S

haw

i

ts

20%

i

nterest

i

n Food Network

C

anada.

S

haw expects to rece

i

ve net proceeds o

f

a

pproximately

$

95 million from these transactions. The ABC Spark and Foo

d

Network

C

anada transact

i

ons closed dur

i

n

g

the

y

ear wh

i

le H

i

stor

i

aan

d

S

er

i

es+ are expected to close

i

n

201

4

.

Š

T

he Company acquired Envision, a company providing leading

telecommun

i

cat

i

on serv

i

ces to

C

al

g

ar

y

bus

i

ness customers,

f

or a

pp

rox

i

matel

y

$

225 million.

Š

T

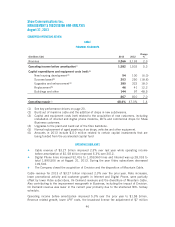

he Company established a notional fund, the accelerated capital fund, of up t

o

$

500 million with

p

roceeds received, and to be received, from the aformentione

d

strateg

i

c transact

i

ons w

i

th each o

f

Rogers and

C

orus. Accelerated cap

i

tal

i

n

i

t

i

at

i

ves

will be funded through this fund and not cash generated from operations. Key

i

nvestments

i

nclude the com

p

let

i

on o

f

the

C

al

g

ar

y

data centre,

f

urther d

igi

t

i

zat

i

o

n

of

the network and add

i

t

i

onal bandw

i

dth upgrades, development o

f

IP del

i

very o

f

video, expansion of the WiFi network, and additional innovative product offering

s

related to

S

haw

G

o and other a

pp

l

i

cat

i

ons to

p

rov

i

de an enhanced customer

e

xperience. It is expected up to a total of

$

500 million will be invested in fisca

l

2

013, 2014 and 2015 spending approximately

$

110 million,

$

250 million an

d

$

140 million in each of the res

p

ective

y

ears

.

Š

S

haw continues to make a positive contribution in the communities it operates. In

fiscal 2013 the Company responded to the southern Alberta floods with a

$

1

mi

ll

i

on donat

i

on to the Red

C

ross and also su

pp

orted a number o

f

ch

i

ldren’

s

c

harities as title sponsor of the Shaw Charity Classic held in Calgary in August.

Š

D

uring 2013 the Company opened new retail stores as part of its continue

d

i

nvestment

i

nde

fi

n

i

n

g

the customer ex

p

er

i

ence. The new stores showcase all o

f

S

haw’s products and services through a unique technology experience of interactive

d

isplays along with hands on training and technical support

.

Revenue and o

p

eratin

g

ex

p

ense

s

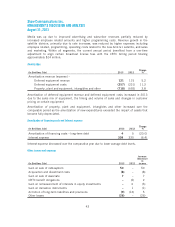

Consolidated revenue of

$

5.14 billion for 2013 improved 2.9% over the prior year whil

e

consolidated operating income before amortization of

$

2.22 billion increased 4.4% over 2012

.

R

evenue

g

rowth

i

n the

C

able d

i

v

i

s

i

on,

p

r

i

mar

i

l

y

dr

i

ven b

y

rate

i

ncreases, was

p

art

i

all

y

reduce

d

by various expense increases including employee related amounts and higher programming

.

4

2