Shaw 2013 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

N

O

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

August 31, 2013 and 201

2

[all amounts in millions of Canadian dollars exce

p

t share and

p

er share amounts

]

2012

C

able

$

M

ed

ia

$

S

atell

i

te

(1)

$

I

ntersegment

e

l

i

m

i

nat

i

on

s

$

T

otal

$

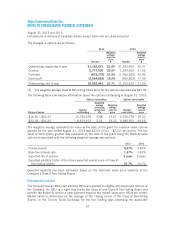

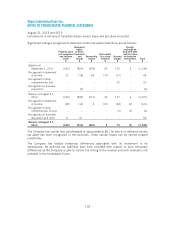

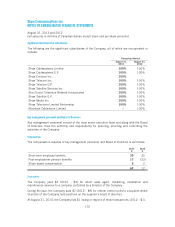

Revenue 3,193 1,053 844 (92) 4,998

Op

erat

i

n

gi

ncome be

f

ore amort

i

zat

i

on

1

,5

02 332 293

–

2

,

12

7

A

mort

i

zat

i

on(2

)

(808)

O

perating income

1

,319

Op

erat

i

n

gi

ncome be

f

ore amort

i

zat

i

on as

%

o

f

revenue 47.

0% 31

.5

%3

4.7

%

–4

2

.

6%

In

te

r

est

(2

)

3

2

9

Burrard Landing Lot 2 Holdings Partnershi

p

1

330

Cas

h

ta

x

es

(2)

282

C

orporate

/

othe

r

(2

5

)

2

57

C

ap

i

tal expend

i

tures and equ

i

pment costs

(

net

)

by segmen

t

C

a

pi

tal ex

p

end

i

tures 7

29 31 11

–77

1

E

q

u

ip

ment costs

(

net

)81

–

83

–

164

810 31 9

4–

935

Reco

n

c

ili

at

i

o

n

to Co

n

so

li

dated State

m

e

n

ts o

f

Cas

hFl

o

w

s

A

dditions to

p

ro

p

ert

y

,

p

lant and e

q

ui

p

men

t

730

A

dditions to e

q

ui

p

ment costs (net)

1

7

8

A

dditions to other intan

g

ible

s

65

Total o

f

ca

pi

tal ex

p

end

i

tures and e

q

u

ip

ment costs

(

net

)p

er

C

onsol

i

date

d

S

tatements o

fC

ash Flows

9

7

3

D

ecrease

i

n work

i

n

g

ca

pi

tal related to ca

pi

tal ex

p

end

i

tures

(10)

Increase

i

n customer e

q

u

ip

ment

fi

nanc

i

n

g

rece

i

vable

s

(16)

Less: Proceeds on d

i

s

p

osal o

fp

ro

p

ert

y

,

p

lant and e

q

u

ip

ment

(9)

Less: Satellite services e

q

ui

p

ment

p

rofi

t

(3)

(

3

)

Total ca

pi

tal ex

p

end

i

tures o

f

e

q

u

ip

ment costs

(

net

)

re

p

orted b

y

se

g

ments

93

5

(1) The Satellite se

g

ment was

p

reviousl

y

re

p

orted as DTH and Satellite Services. These

se

g

ments have been comb

i

ned

i

nto a s

i

n

g

le o

p

erat

i

n

g

se

g

ment

f

or re

p

ort

i

n

gp

ur

p

ose

s

which is consistent with the operating segment reporting that is provided to the chie

f

op

eratin

g

decision makers.

(2) The Com

p

an

y

does not re

p

ort amortization, interest or cash taxes on a se

g

mented basis.

(3) The

p

rofit from the sale of satellite e

q

ui

p

ment is subtracted from the calculation o

f

se

g

mented ca

pi

tal ex

p

end

i

tures and e

q

u

ip

ment costs

(

net

)

as the

C

om

p

an

y

v

i

ews the

profit on sale as a recovery of expenditures on customer premise equipment

.

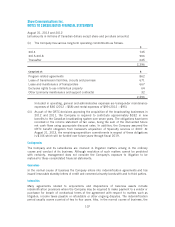

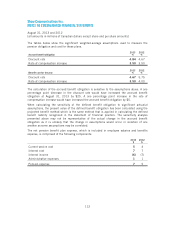

25. COMMITMENTS AND CONTINGENCIES

Co

mmi

t

m

e

n

ts

(i) The Company owns and leases Ku-band and C-band transponders on the Anik F1R, Anik

F

2 and Anik G1 satellites. As part of the Ku-band transponder agreements with Telesa

t

C

anada, the

C

om

p

an

yi

s comm

i

tted to

p

a

yi

n

g

annual trans

p

onder ma

i

ntenance and

l

icense fees for each transponder from the time the satellite becomes operational for

a

period of 15 years

.

106