Shaw 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

MANA

G

EMENT’

S

DI

SCUSS

I

O

N AND ANALY

S

I

S

August

31

,

2013

E

arn

i

ngs per s

h

are

(

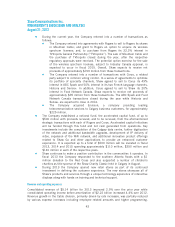

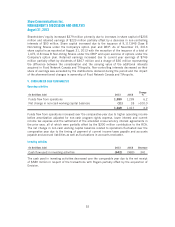

In $millions Cdn except per share amounts) 2013 201

2

C

han

g

e

%

Net income 784 761 3.0

Weighted average number of participating

shares outstandin

g

durin

gp

eriod (millions

)

4

4

8

441 1.6

Earn

i

ngs per share

Basic 1.64 1.62 1.2

Dil

uted

1.

63

1.

6

1 1.2

Net income from continuin

g

o

p

erations

N

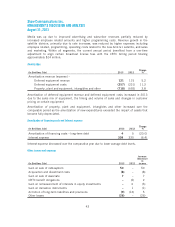

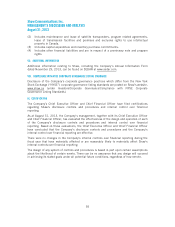

et income was

$

784 million in 2013 compared to

$

761 million in 2012. The year-over-year

chan

g

es are summarized in the table below

.

N

et income increased

$

23 million over the

p

rior

y

ear. The current

y

ear benefited from hi

g

her

op

eratin

g

income before amortization of $93 million, im

p

roved net other costs and revenue o

f

$

23 million, and lower interest expense of

$

21 million, the total of which was partially reduced

b

y

increased amortization of

$

45 million and hi

g

her income taxes of

$

69 million. The im

p

rove

d

n

et other costs and revenue

i

ncluded the

g

a

i

n on the sale o

f

Mounta

i

n

C

able. The h

ig

he

r

income taxes resulted as the comparable period benefited from a tax recovery related to th

e

resolution of certain tax matters.

(

In $millions Cdn

)

Increased o

p

erat

i

n

gi

ncome be

f

ore amort

i

zat

i

o

n

93

Increased amortizatio

n

(45)

Decreased

i

nterest ex

p

ens

e

21

C

hange in other net costs and revenu

e

(

1

)

23

D

ec

r

eased i

n

co

m

eta

x

es

(69)

23

(1) Net other costs and revenue includes gain on sale of cablesystem, acquisition an

d

d

ivestment costs, gain on sale of associate, gain on remeasurement on interests in equity

i

nvestments,

C

RT

C

bene

fi

t obl

ig

at

i

ons,

g

a

i

n on der

i

vat

i

ve

i

nstruments, accret

i

on o

f

lon

g

-

term liabilities and provisions and other losses as detailed in the Consolidated Statement

s

o

f Income

.

45