Shaw 2013 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

N

O

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

August 31, 2013 and 201

2

[all amounts in millions of Canadian dollars exce

p

t share and

p

er share amounts

]

2

4. B

US

INE

SS S

E

G

MENT INF

O

RMATI

ON

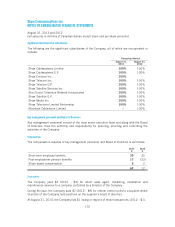

The Com

p

an

y

’s o

p

eratin

g

se

g

ments are Cable, Media and Satellite, all of which are

substant

i

all

y

located

i

n

C

anada. The account

i

n

gp

ol

i

c

i

es o

f

the se

g

ments are the same as those

d

escribed in the summary of significant accounting policies. Management evaluates divisional

performance based on revenue and operating income before charges such as amortization.

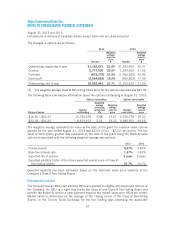

2013

C

able

$

M

ed

ia

$

S

atell

i

te

(

1

)

$

I

ntersegment

e

l

i

m

i

nat

i

on

s

$

T

otal

$

Re

v

e

n

ue

3

,266 1,106 860 (90) 5,14

2

Op

erat

i

n

gi

ncome be

f

ore amort

i

zat

i

on

1

,5

82 3

5

328

5–

2

,

220

A

mort

i

zat

i

on

(

2

)

(8

54

)

O

perating income 1

,

366

Op

erat

i

n

gi

ncome be

f

ore amort

i

zat

i

on as

%

o

f

revenue 4

8

.4

%31

.

9% 33

.

1%

–4

3

.

2%

In

te

r

est

(2

)

308

Burrard Landin

g

Lot 2 Holdin

g

s Partnershi

p

1

309

C

ash taxes

(

2

)

300

C

or

p

orate

/

othe

r

(138)

1

62

C

ap

i

tal expend

i

tures and equ

i

pment costs

(

net

)

by segmen

t

C

apital expenditure

s

8

2

53

142 –

898

E

q

ui

p

ment costs (net

)

4

2 – 81 – 123

86

7

31 123

–

1

,

021

R

econciliation to Consolidated Statements of Cash Flow

s

A

dd

i

t

i

ons to

p

ro

p

ert

y

,

p

lant and e

q

u

ip

men

t

802

A

dd

i

t

i

ons to e

q

u

ip

ment costs

(

net

)

132

A

dd

i

t

i

ons to other

i

ntan

gi

ble

s

69

Total of ca

p

ital ex

p

enditures and e

q

ui

p

ment costs (net)

p

er Consolidate

d

State

m

e

n

ts o

f

Cas

hFl

o

w

s

1

,

003

Increase in workin

g

ca

p

ital related to ca

p

ital ex

p

enditures

33

Increase

i

n customer e

q

u

ip

ment

fi

nanc

i

n

g

rece

i

vable

s

(9)

Less: Proceeds on d

i

s

p

osal o

fp

ro

p

ert

y

,

p

lant and e

q

u

ip

men

t

(3)

Less:

S

atell

i

te serv

i

ces e

q

u

ip

ment

p

ro

fi

t

(

3

)

(3)

Total capital expenditures of equipment costs (net) reported by segments 1

,

02

1

S

ee notes

f

ollow

i

ng

2012

bus

i

ness segment table.

105