Shaw 2013 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

N

O

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

August 31, 2013 and 201

2

[all amounts in millions of Canadian dollars exce

p

t share and

p

er share amounts

]

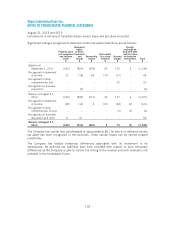

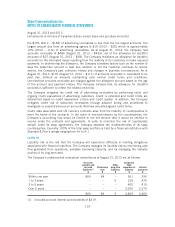

The tables below show the significant weighted-average assumptions used to measure the

p

ension obli

g

ation and cost for the

p

lans.

A

ccrued bene

fi

t obl

ig

at

i

o

n

2013

S

ER

P

%

2013

ERP

%

2012

S

ER

P

%

D

iscou

n

t

r

ate

4

.

75 4

.

75

4.

50

Rate o

f

compensat

i

on

i

ncrease

5

.

00

(1)

3

.

00

5

.

00

(1)

Benefit cost for the year

2013

SER

P

%

2013

ER

P

%

2012

SER

P

%

Discount rate

4

.50 4.20 5.50

Rate o

f

com

p

ensat

i

on

i

ncrease

5

.

00

(

1)

3

.

00

5

.

00

(1) Applies only to incentive compensation component of eligible pensionable earnings

.

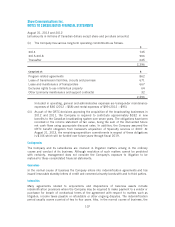

The calculation of the accrued benefit obligation is sensitive to the assumptions above. A one

p

ercenta

g

e

p

o

i

nt decrease

i

n the d

i

scount rate would have

i

ncreased the accrued bene

fit

o

bligation at August 31, 2013 by $68. A one percentage point increase in the rate o

f

compensation increase would have increased the accrued benefit obligation by

$

13

.

W

hen calculatin

g

the sensitivit

y

of the defined benefit obli

g

ation to si

g

nificant actuaria

l

assum

p

t

i

ons, the

p

resent value o

f

the de

fi

ned bene

fi

t obl

ig

at

i

on has been calculated us

i

n

g

the

projected benefit method which is the same method that is applied in calculating the define

d

benefit liabilit

y

reco

g

nized in the statement of financial

p

osition. The sensitivit

y

anal

y

sis

p

resented above ma

y

not be re

p

resentat

i

ve o

f

the actual chan

g

e

i

n the accrued bene

fit

o

bligation as it is unlikely that the change in assumptions would occur in isolation of one

another as some assum

p

tions ma

y

be correlated

.

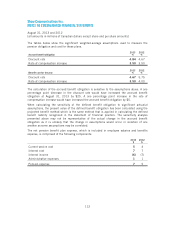

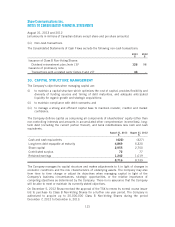

The net

p

ension benefit

p

lan ex

p

ense is com

p

rised of the followin

g

com

p

onents

:

S

ER

P

$

ERP

$

2013

Tota

l

$

2012

S

ER

P

$

Cu

rr

e

n

tse

rv

ice cost

82 10

7

Past service cos

t

4– 4

–

In

te

r

est cost

17

–

17

19

Interest incom

e

(

13

)

–

(

13

)

–

Gain – past service adjustment

s

–– –

(

25)

Pension expense 1

6

21

8

1

The components of pension expense are included in employee salaries and benefits except for

t

he

g

a

i

n

i

n res

p

ect o

fp

ast serv

i

ce ad

j

ustments wh

i

ch

i

s

i

ncluded

i

n other losses

i

n the

i

ncom

e

state

m

e

n

t.

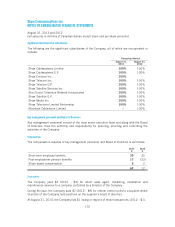

R

e

g

istered

p

ension

p

lans

The

C

ompany has a number o

ff

unded de

fi

ned bene

fi

t pens

i

on plans wh

i

ch prov

i

de pens

i

o

n

benefits to certain unionized and non-unionized employees in the media business. Benefits

u

nder these

p

lans are based on the em

p

lo

y

ees’ len

g

th o

f

serv

i

ce and

fi

nal avera

g

e salar

y

. These

plans are regulated by the

Offi

ce o

f

the

S

uper

i

ntendent o

f

F

i

nanc

i

al Inst

i

tut

i

ons,

C

anada

i

n

111